Why You Should Enroll in a Medicare Supplement Plan

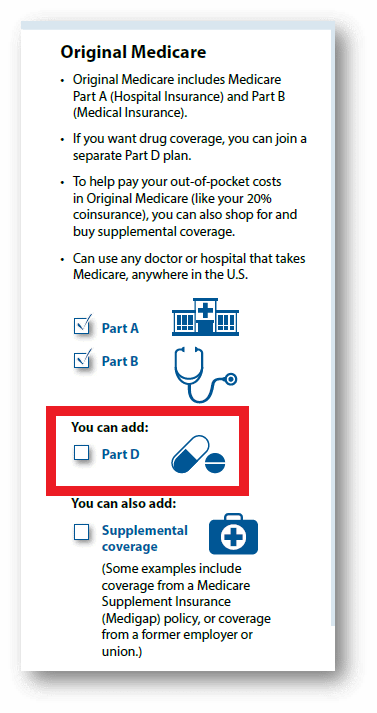

People who qualify for Medicare at 65 have multiple options.

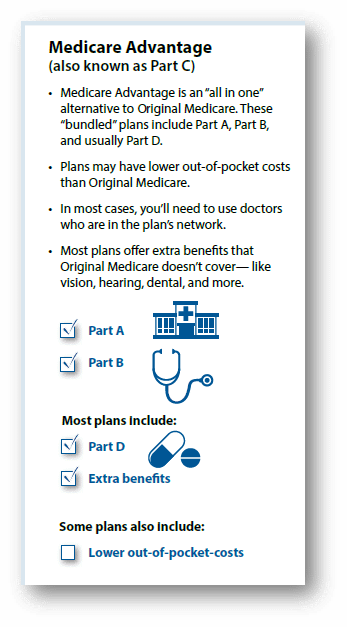

One of the options is called Part C Medicare Advantage. These plans for the most part include Part D drug coverage within the policy.

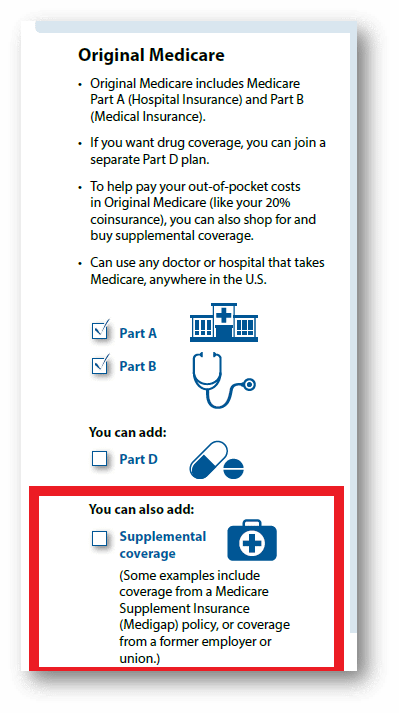

The other type of policy is called Medigap. Medigap plans are also known as Medicare Supplement plans. Medigap plans can be paired with a standalone Part D drug plan. So why should you enroll in a Medicare Supplement plan?

Here are the top 5 reasons to enroll in a Medicare Supplement Plan:

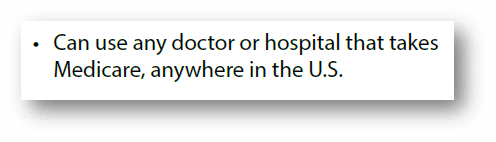

#1 Nationwide Network

One of the top 5 reasons to enroll in a Medicare Supplement Plan is the nationwide network.

Every Medigap plan is required to contract with the same doctors, regardless of which plan or carrier you enroll in. Any doctor or facility in the nation that accepts ‘Medicare Assignment’ will work with your policy.

This robust nationwide network is searchable online on Medicare’s website. Most major hospitals and facilities accept Medicare, which allows members to receive health care at the best facilities across the country.

– Going to Medicare’s website and clicking the “Find care providers” button can reveal which physicians and facilities accept Medicare.

#2 Low Out of Pocket Expenses

One of the top 5 reasons to enroll in a Medicare Supplement Plan is low out-of-pocket expenses.

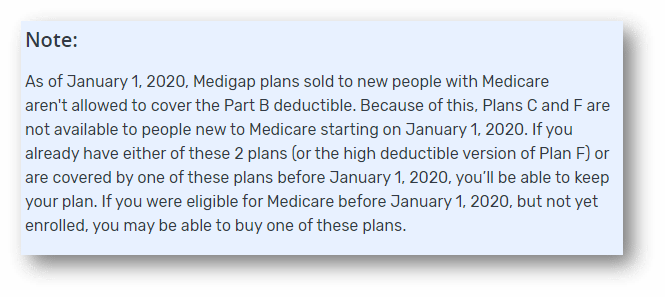

If you qualify for Medicare before 2020, you can apply for the Plan F which has no out-of-pocket expenses for approved Medicare services.

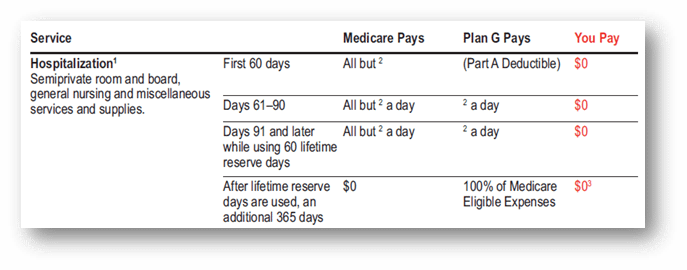

The Plan G has limited out-of-pocket expenses. Your annual out-of-pocket costs will be limited to your Part B Deductible.

In 2024 the Part B deductible is $240 which is an increase from $226 in 2023. To learn more about the differences between Plan F and Plan G, please click here.

There are many more Medigap plans available with different out-of-pocket thresholds. Depending on the plan you select, you may save thousands of dollars compared to a Part C Medicare Advantage Plan.

#3 Customized Drug Coverage

Another top reason to enroll in a Medicare Supplement Plan is the ability to customize your drug coverage.

Every year, you can change your drug plan based on your needs.

You can enroll in drug coverage with any carrier that offers a Part D plan where you live. You can apply for these plans during the Annual Enrollment Period. The Annual Enrollment Period starts on 10/15 and ends on 12/7 for coverage starting 1/1.

Part D drug plans do not ask health questions.

Unlike Part C Medicare Advantage Plans, you can choose a plan based on your needs. Part C Medicare Advantage Plans offer drug coverage, but you cannot modify the drug plan within the policy. Furthermore, you cannot enroll in a standalone Part D Drug plan with a Part C Medicare Advantage Plan.

#4 No HMO

One of the top 5 reasons to enroll in a Medicare Supplement Plan is that these plans are not HMO.

Most Part C plans are HMO and force you to select a primary care physician with a limited network. Medigap plans do not require you to select a Primary Care Physician. Furthermore, Medicare Supplement plans do not require you to get a referral before seeking medical care with a Specialist.

#5 Regulated Benefits

One of the top 5 reasons to enroll in a Medicare Supplement Plan is the regulated benefit structure.

Every insurance carrier must offer the same plans. For example, a Plan G with one insurance company is the same in benefit as any other Plan G available in the market. This regulated structure protects consumers and helps keep the insurance shopping process simple for applicants.

How to Apply

Medigap plans sometimes require people to answer health questions.

Insurance companies can deny you based on health history and prescriptions if you are not in a Guaranteed Issue Period.

Fortunately, you can apply for a Medigap plan at any time of the year.

To learn more about your eligibility and the requirements to enroll, please give us a call today. One of our licensed brokers will guide you through the enrollment process at no extra cost to you.