Medicare is always changing. And this year, Congress plans to make several improvements to make healthcare more affordable for people in Nevada and across the country under the Inflation Reduction Act. Here are some of the main Medicare Part D changes for 2025.

Eliminate coverage gap phase from standard Part D benefit structure

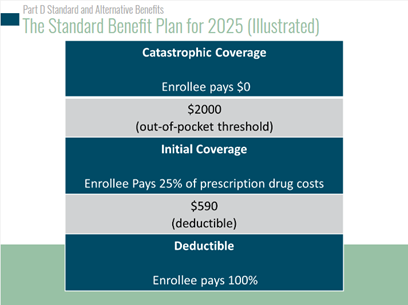

Most Medicare prescription drug plans have what’s called a coverage gap (or “donut hole”), which is a set time period when there are temporary limits to what the drug plan will cover. The gap begins once you and your plan combined reach a specific spend limit. Once you reach the limit, you’re in the “coverage gap,” and the cost-sharing through your plan changes.

Part of the Medicare Part D changes for 2025 include eliminating this coverage gap phase, so you don’t have to worry about varying cost-sharing throughout the year. Everything remains set throughout the year, so you don’t have to keep track of when you might reach the coverage gap limit.

Cap beneficiary out-of-pocket costs at $2,000

Currently, the average out-of-pocket costs to reach the Part D catastrophic threshold is around $3,300. In 2025, Medicare will cap the beneficiary out-of-pocket costs to $2,000, making it easier to reach the catastrophic threshold and save more money on drug costs.

This is especially helpful for those taking brand-name drugs, as they could save about $1,300 in 2025 compared to what they spent in 2024.

Adding a new Medicare Prescription Payment Plan

It’s not always easy to come up with the money upfront to pay for prescriptions at the pharmacy. In 2025, Part D enrollees can opt into a Medicare Prescription Payment Plan that bills them monthly for any out-of-pocket drug costs.

Instead of paying for medication at the pharmacy, you don’t pay a cent when you receive your medication. Your Medicare plan provider will instead send you monthly bills, spreading the cost over time.

This new plan will mostly benefit those who incur higher drug costs at the beginning of the year, but any Medicare Part D enrollee may opt in.

Which Medicare Part D plan is right for you?

Navigating Medicare changes can be complicated, but the health insurance professionals at Health Benefits Associates is here to help! Our team of experienced agents will answer your questions and help you determine the best plan for your unique needs. Contact us today to go over your options and discuss how Medicare Part D changes for 2025 might impact your coverage.