As Californians approach Medicare eligibility, it is important to have an understanding on Medicare Supplement in California. Medicare Supplement (also known as Medigap) is a type of health insurance offered by private insurance companies for people over 65, some people who are under 65 with disabilities, and anyone with End Stage Renal Disease. If any of these circumstances apply to you, here are 6 essential facts for you to know about Medicare Supplement in California:

1. Eligibility for Medicare Supplement in California

To qualify for Medicare Supplement in California, you must be enrolled in both Part A and Part B of Medicare. If you are receiving Social Security benefits, you are usually automatically enrolled in Part A and Part B. It is important you enroll in BOTH Parts A and B prior to applying for additional coverage through private Medicare insurance companies. The Social Security Administration handles Medicare Part A and B applications. There are 3 ways to enroll:

- Enroll in Part A & B online

- Enroll over the phone by calling Social Security Administration at (800) 772-1213

- Apply in person at a local Social Security Administration office

2. Plan Benefits are standardized

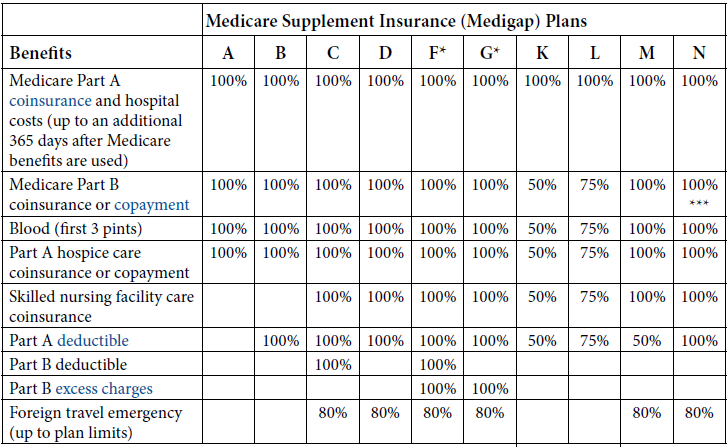

Currently, there are 10 Medicare Supplement plans available (A, B, C, D, F, G, K, L, M, N). Each plan offers different benefits, allowing individuals to choose a plan that best suits their needs and budget. These Medicare Supplement plans (A, B, C, D, F, G, K, L, M, N) are standardized by the federal government. This means that the benefits offered by each plan type are the same, regardless of the insurance company providing coverage. For example, Plan G will offer the same level of medical coverage regardless which company your plan is through.

3. Access to Care

Similar to plan benefits, access to providers does not vary from plan to plan. When enrolled in Medicare Supplement in California, you will be able to access any doctor or facility in the nation that accepts Medicare.

4. Premiums

Private insurance companies charge premiums for Medicare Supplement in California, this is in addition to the Part B premium paid to the federal government. Medicare Supplement premiums will vary depending on the level of coverage you select, your age, and where you live. There can also be large differences in premiums that different insurance companies charge for the same level of coverage, some companies even offer premium discounts. This is why it is important to shop options before choosing which insurance company to enroll with.

5. Prescription Drug Coverage is NOT Included

Medicare Supplement plans do not include prescription drug coverage (also known as Part D). Part D coverage will need to be purchased separately from Medicare Supplement. Even if you are not taking any drugs today, it is important you enroll in a minimum plan to avoid a lifetime penalty. To learn more about how to enroll in a Part D drug plan, click here.

6. When to Enroll

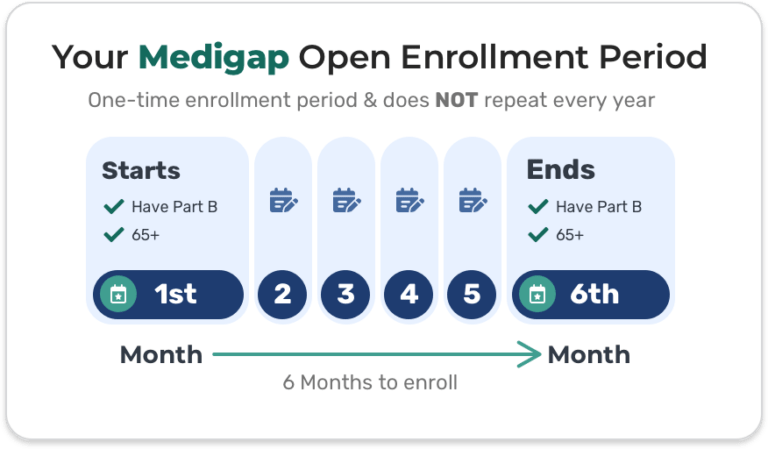

The best time to enroll into Medicare Supplement in California is during your 6 month Medigap Open Enrollment period. This enrollment period takes place around the time that you initially enroll into Medicare Part B.

Certain situations known as “guaranteed issue rights” will guarantee your ability to enroll into Medicare Supplement outside of your Medigap Open Enrollment period. If you have experienced a situation that qualifies as guaranteed issue, any Medicare Supplement company offered where you live must accept your enrollment.

If you do not qualify for Medigap Open Enrollment or a guaranteed issue situation, you can attempt to enroll through health underwriting. If you apply for coverage through health underwriting there is no guarantee you will be accepted.