Health insurance is expensive! Fortunately, there is a way to save money while getting major medical coverage with a 2024 Health Savings Account in Nevada!

Major Medical Plans In a Nutshell

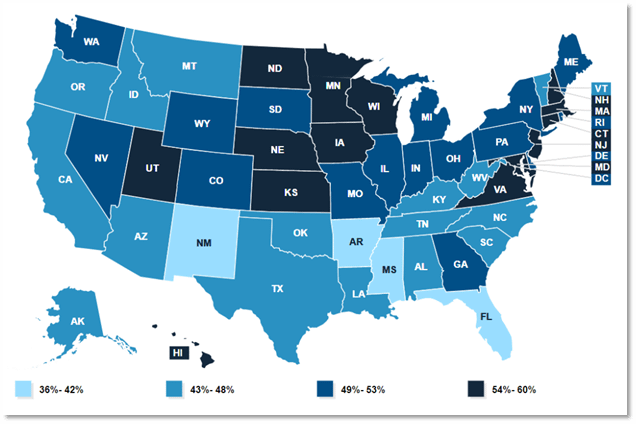

Major medical plans come in many different forms. For the most part people get plans through their employer. As of January 11, 2021 the Kaiser Family Foundation estimated that nearly 49% of Americans get employer-sponsored health insurance.

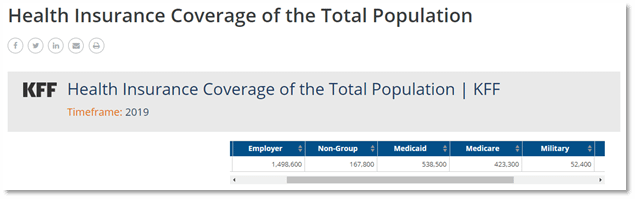

Many people get insurance elsewhere! In 2019, the Kaiser Family Foundation estimated that people in Nevada got insurance through:

- Individual and Family plans – 5.5%

- Medicaid – 17.8%

- Medicare – 14.0%

- Military – 1.7%

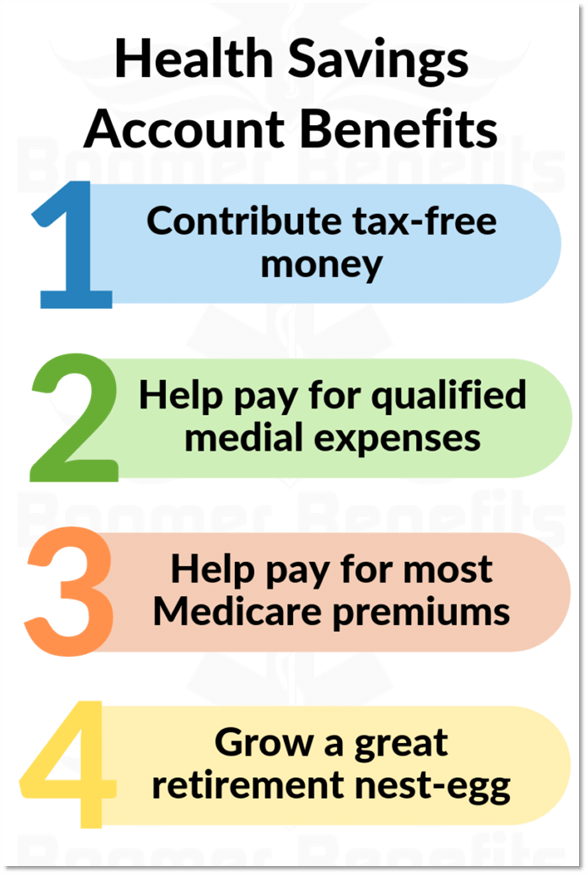

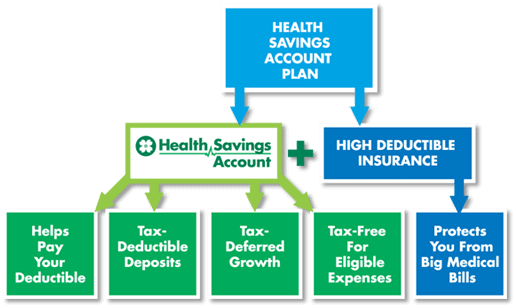

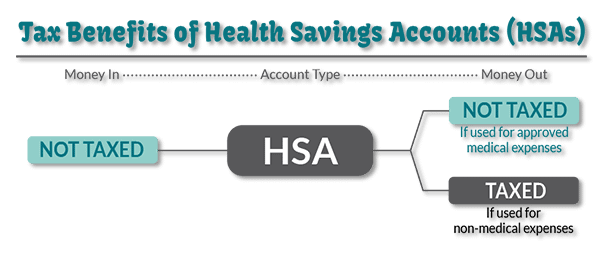

Some major medical plans allow people to contribute pretax monies into a Health Savings Account (“HSA”). There are a few basic rules to follow:

- Your health plan must be “HSA-Compatible”

- You cannot be enrolled in Medicare

What is a Health Savings Account?

A Health Savings Account is also known as an HSA. The easiest way to think of an HSA is to compare it to an IRA retirement account.

For this example, let’s imagine a Traditional IRA. You contribute pretax monies into your IRA. Your IRA is your account and it follows you wherever you go, even if you change employers.

There are A LOT of differences between an HSA and an IRA. The big difference — when you contribute pretax monies into your HSA, you can use them at anytime without penalties! You do not need to wait until a certain age to use your pretax HSA contributions.

The Law of the Land

The IRS regulates rules on how you can spend money from your HSA. They also update rules on type of plans qualify for pretax HSA contributions.

Best of all, the rules are constantly changing! Once you think you know all the rules, the IRS will most likely update a rule to keep you on your toes!

HSA-Compatible Health Plan Rules

Let’s start with some basic rules on the Health Insurance plan you need to take advantage of pretax contributions:

- Your health insurance plan must have a high deductible.

- Your health insurance plan cannot offer copay benefits before the deductible is satisfied.

- The health insurance policy must be classified as major medical.

- The plan cannot exceed the maximum out of pocket threshold established by the IRS.

Every year, the IRS changes the deductible and maximum out of pocket thresholds. We will discuss the latest/current thresholds later in this article.

HSA Pretax Contribution Rules

Once you have a health plan that is HSA-Compatible, you can now start contributing pretax monies into your HSA!

If you need help setting up a bank account for your HSA, we recommend talking to your current bank. You can also contact Optum Bank. Optum Bank administers HSA’s nationwide.

Did you know that Optum Bank took over all of the HSA accounts from Wells Fargo on December 31, 2016? This transfer of accounts was approved by the Federal Deposit Insurance Corporation (FDIC).

In simple terms — Optum Bank is a major player in the world of HSA’s! If you decide to go with Optum Bank (or any other HSA Bank), they will advise you on what expenses and procedures are eligible for pretax payments from your Health Savings Account.

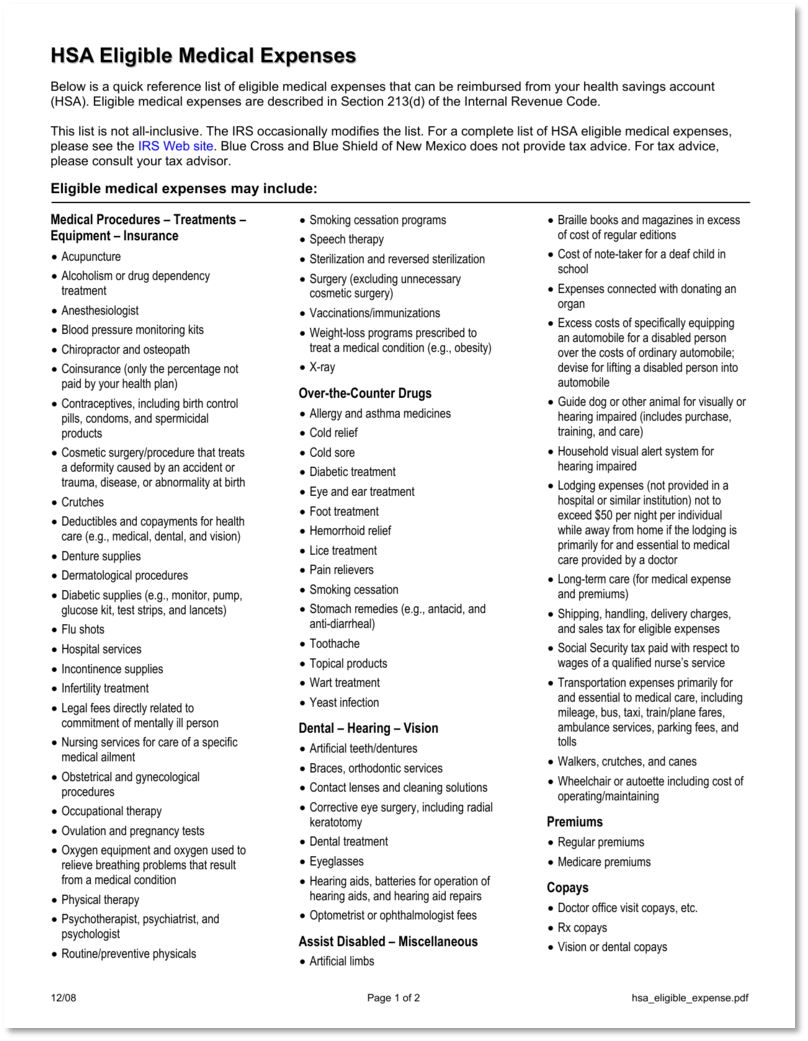

When spending money from your HSA, you want to make sure you are using your funds on approved/eligible expenses. The list of eligible expenses changes sometimes by the order of the IRS.

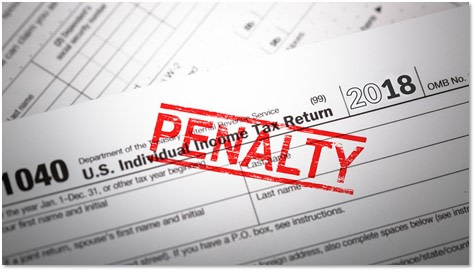

Be Careful — If you do not spend your HSA funds correctly, you may receive a tax penalty from the IRS when you file your taxes!

Did You Know?

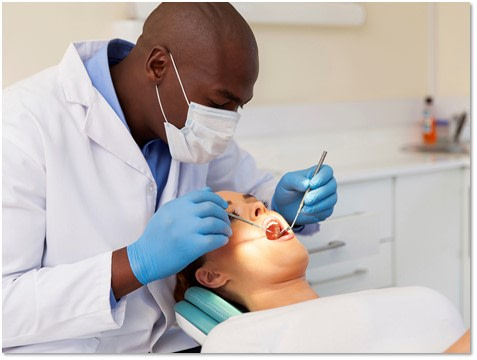

Did you know that you can use your pretax monies from your HSA account on vision and dental needs? YES — dental and vision claims are classified as eligible expenses from your Health Savings Account!

HSA’s Are Not For Everyone!

To get pretax contributions, the trade off is that you will have a health insurance with high deductible requirements. This means that when you use the plan, you will incur high out of pocket expenses!

Enrolling in an HSA-Compatible health plan for the sake of contributing pretax monies into your HSA is a risk! The best times to enroll in an HSA-Compatible health plan are:

- If you expect a healthy year with low claims

- Your employer is matching your contributions into your HSA

- You need a low costing health plan (which happens to be HSA-compatible)

- You have an upcoming major medical expense in a future year (like a planned surgery or childbirth)

Keep in mind — If you have an HSA-Compatible health plan, you are not required to contribute into an HSA. Also, you are not required to have a health savings account through a bank!

Did You Know?

Did you know you can always spend pretax monies from your HSA, even if you don’t have health insurance? You can even spend pretax monies on eligible expenses when you are in Medicare!

In simple terms – pretax monies in your HSA can always be spent regardless of the health insurance plan you are enrolled in. To add more pretax funds into your account, you need to be enrolled in a health insurance plan that meets the HSA-compatibility requirements established by the IRS.

2024 Health Savings Accounts in Nevada

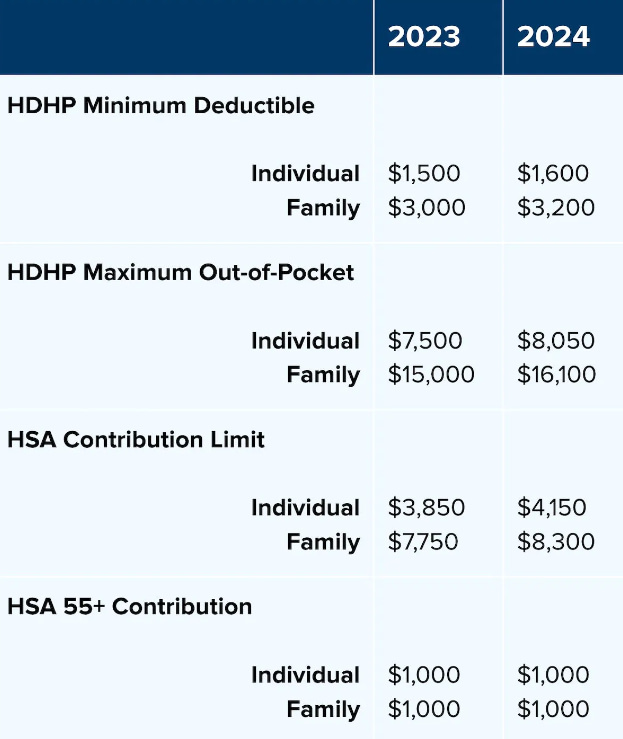

The IRS released the benefit and contribution thresholds for people with a 2024 Health Savings Account in Nevada. Remember — these thresholds change each year and impact two major aspects of your coverage:

- Each year, HSA-Compatible health plans must meet certain benefit requirements to qualify for pre-tax HSA contributions. To learn more about HSA’s in general, please click here.

- The IRS also allows a maximum pre-tax contribution per year if you are enrolled in an HSA-Compatible health plan.

The IRS recently published the chart below. It compares the differences between 2022 and 2023 Health Savings Accounts in Nevada:

Here’s a tip — make sure to consult your accountant before contributing monies into your HSA. You may qualify for a family contribution or catch-up contribution on your 2024 Health Savings Account in Nevada!

Taking Action Today to Save Money Tomorrow!

We help people enroll in HSA-Compatible health plans!

If you need help understanding the pros and cons of an HSA-Compatible health plan, please give us a call. One of our licensed brokers can help you understand your options at no cost to you.