Comparing Medicare Advantage vs Medicare Supplement in Nevada

You have a lot of options when it comes to Medicare plans. Not only are there a lot of options, but they can be very confusing. You have plans, parts, advantage, and supplements. These are all terms you will come across when you start to look at Medicare Advantage plans and Medicare Supplement plans. I am here to breakdown Medicare Advantage vs Medicare Supplement in Nevada.

Understanding Medicare

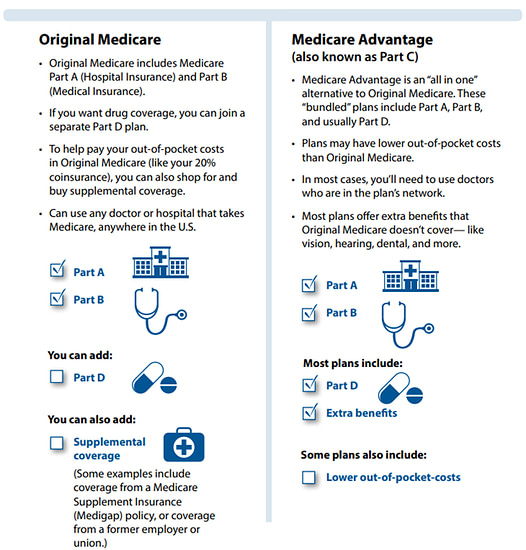

In order to take a deep dive into Medicare Advantage and Medicare Supplement plans, we will need to have a good understanding of what Medicare is. Original Medicare is comprised of two parts, A and B.

Part A of Medicare is going to cover your inpatient and hospital needs. When someone turns 65, they are typically enrolled in part A automatically. As long as someone has worked for 10 years and paid taxes, they should receive part A for $0.

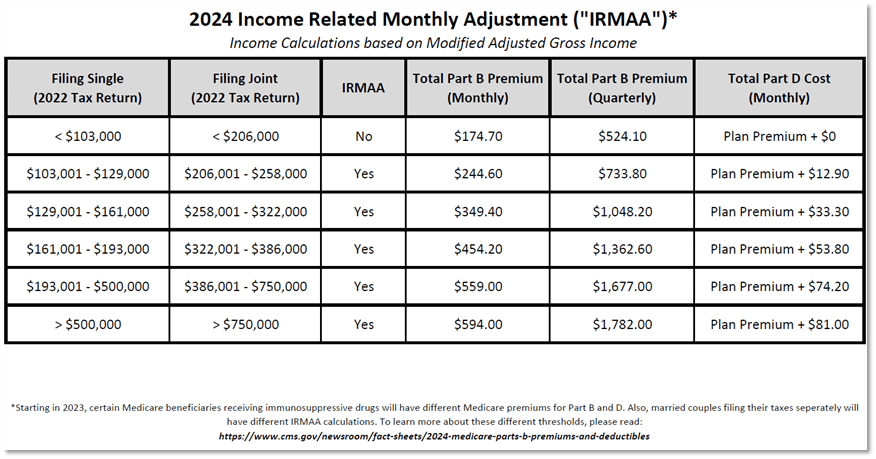

Part B of Medicare, however, is not $0. Part B of Medicare has a premium attached to it. This premium is going to be determined by your income from two years ago. You can see an example of the chart below for 2024.

Starting in 2023, certain Medicare beneficiaries receiving immunosuppressive drugs will have different Medicare premiums for Part B and D. Also, married couples filing their taxes separately will

have different IRMAA calculations. To learn more about these different thresholds, please click here.

Part B of Medicare covers someone’s outpatient procedures. This includes doctor’s visits, therapies, labs, and preventative procedures.

Part A and B is considered Original Medicare. Original Medicare covers 80% of your medical expenses and leaves the insured with 20% of the bill. Having both parts A and B qualifies you for a private Medicare plan. This is where we will discuss the differences of Medicare Advantage vs Medicare Supplement in Nevada

Medicare Advantage vs Medicare Supplement in Nevada

Now that we have a good understanding of what Original Medicare is, lets dive into the differences between the two private plans.

Medical Underwriting on Medicare Advantage vs Medicare Supplement

The term pre-existing conditions usually comes to mind when people think health insurance. In 2014, Obamacare plans got rid of pre-existing conditions and underwriting. Medicare however, is a completely different world.

Do private Medicare plans require underwriting? The answer is yes AND no.

Let’s look at Medicare Supplement plans. Medicare Supplement plans require underwriting, but only sometimes. What do I mean by that? Well, it depends on when a person is applying. If someone applies within 6 month’s of their Part B start date, then no underwriting. If someone tries to apply after the 6 month mark, then they will need to answer health questions. Health questions vary by carrier. Some have relatively lax underwriting while others have strict underwriting.

Does Medicare Advantage require underwriting? No!

Medicare Advantage will never require someone to answer health questions. If a company or broker asks you health questions when applying for a plan, it’s not Medicare Advantage. It does not matter if you are applying when you are 65 or when you are 85. There will never be health questions.

Extra Benefits

When comparing Medicare Advantage vs Medicare Supplement in Nevada, make sure to look at all the benefits. Both Medicare Supplement and Medicare Advantage can provide extra benefits.

What are extra benefits? Things like dental, vision, and gym memberships come to mind. Certain Medicare Advantage plans will provide members with extra benefits. Ultimately, it depends on the carrier. Medicare Supplement plans have recently added extra benefits. However, it is not as common with Medicare Supplement plans.

“Network Lists”

I put network lists in quotations for a reason and I will get to that in a minute. Medicare Advantage is a lot like group and individual health plans. This is because you have to follow the network list that the company provides. Each company contracts with a different list of doctors. You tend to see entire hospital organizations contract with a plan. When someone goes to the doctor, they will need to ask what company’s insurance is taken.

When someone is on a Medicare Supplement, they are technically on Original Medicare. There is no specific “network list”. This is why I put it in quotations. As long as a provider contracts with Original Medicare, they will accept whatever insurance company you go through. For example, Plan G through Aetna covers the exact same thing as Plan G with AARP. These benefits are federally regulated. If you have a Medicare Supplement, then ask your provider if they accept Original Medicare. If the answer is yes, then they take your supplement plan.

Part D Drug Plans

Depending on what route people go, Part D could be included with a private Medicare plan. Let me explain. When someone decides to have a Medicare Supplement policy, Part D drug plans are not included with their medical plan. This gives the Medicare beneficiary freedom to choose whatever drug plan they would like. If you take certain drugs and go to a certain pharmacy, be sure to enter the information in the search tool. The easiest way to get an individual drug plan is to go to Medicare.gov.

When you choose to get a Medicare Advantage plan, there is a good chance it comes with a Part D plan. Most Medicare Advantage plans in Nevada are considered MAPD. Meaning, Medicare Advantage plus Drug Plan. Be sure to speak with your broker about what plans comes with Part D.

AEP vs Birthday Rule

Both Medicare Advantage and Medicare Supplement have their own set of enrollment periods. As of January 1st, 2022 Medicare Supplement plans have their own open enrollment period. This is called the “Birthday Rule”. The Birthday Rule allows a person enrolled in Medicare Supplement to change plans without health questions. You can switch from Plan F to Plan G without health history. This occurs for 60 days around a person’s birthday. For more information on the birthday rule, please reach out to one of our brokers.

The Annual Election Period (AEP) is a time where one can change Medicare Advantage plans. AEP runs from October 15th to December 7th every year. If you don’t like the company you are with, you can freely change to another company. For more information on the Annual Election Period, please contact one of our brokers.

These are some of the biggest difference’s when people look at Medicare Advantage vs Medicare Supplement in Nevada. If you have any more questions regarding the two, please be sure to give us a call at 775-828-1216. One of our brokers will be happy to assist you.