How to Find the Best Medicare Plan

2021 was a record year for Medicare plan advertising.

I’ve learned one thing about turning 65: you actually listen to what Joe Namath and JJ Walker have to say on TV! But in time you also learn to be wary of most of these marketing campaigns. The messages in those particular commercials tell seniors they can save money on Medicare. What these companies are selling is the Part B premium giveback.

There are Advantage plans that pay part of your Part B, lowering the premium cost to you. But not all plans do this. Also, this “premium giveback” is restricted to particular areas of the U.S. That’s why these commercials ask you to call to see if your zip code is eligible.

For what it’s worth, the folks I know in Reno who did make that call. They all tell me their zip codes were not eligible. Even if you are eligible, it may not even be the best option. I’ll tell you where to get the best advice on that in a bit.

Yes, there are fewer ads now

Ads, of course, are now pushing you to make that change. When’s the quiet time away from Medicare plan advertisements? The sweet spot is March 31st to October 15th, when Medicare open enrollment once again begins.

What about those Medicare Advantage plans?

These days they’re very popular and do offer great benefits. You might be asking yourself how to find the best Medicare plan.

Choosing the right Medicare Advantage for you requires expert knowledge of the plans and your situation. Unfortunately, all the Medicare marketing creates quite a bit of confusion.

The government’s complex rules, costs, features, and alphabet plan categories only add to that. For those looking for clear answers and solutions, the waters are muddy for newbie Medicare members like myself.

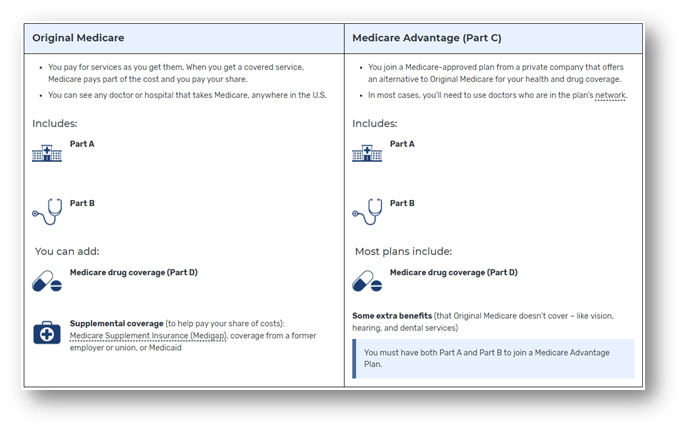

Medicare Part B doesn’t include dental, vision, or hearing coverage. Plus, most Advantage plans include prescription drug coverage, which requires a separate purchase (Part D) with original Medicare.

Advantage plans like the one I chose also include other perks, like my no-cost gym membership. My advantage plan, and many others, offer a zero-dollar premium. You still need to enroll and pay for Part B to qualify and pay your original Medicare premiums.

How to come to the best decision for you

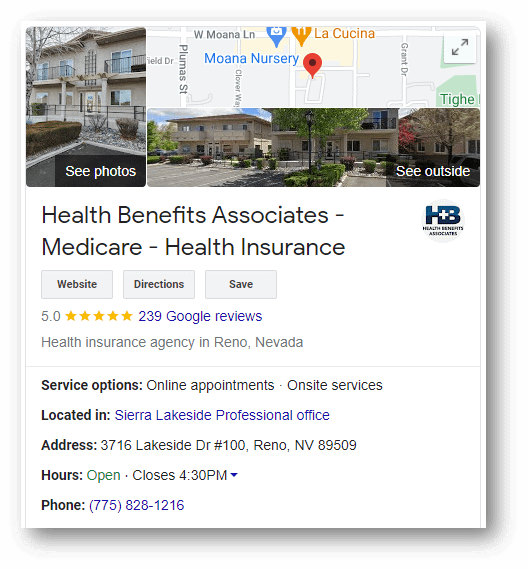

I’ve summarized just a few of the many reasons why you really need to have a no-cost sit down with a local Medicare plan advisor. I selected Health Benefits Associates. They also have an office in Reno, Sparks, Carson City, and Fernley.

Like any matter involving your finances and health, what you know can save you a lot of regrets. It’s been such an enlightening experience for me that I’ve taken up the cause of educating fellow seniors about the ins and outs, and pitfalls to avoid when selecting the best option.

There are MANY differences between all these options, but believe me…there is THE plan out there that fits best for you and your family.