Signing up for Medicare can be a difficult and expensive process if it’s not handled correctly. The timing can be especially important. Because original Medicare parts A and B come from the federal government, they’re not as easy to work with. They don’t issue temporary ID cards and they prefer to run everything through paper mail. If they require an in-person meeting you need to visit the social security office, which frequently has long wait times. Even then, they won’t issue the ID cards in the office – they’ll mail it to you instead. Asking yourself “When should I sign up for Medicare?” can be one of the most important financial and medical decisions you can make.

In this article, I’m going to review the timing surrounding the Medicare enrollment process, and why it’s so important.

There are two general ways to be eligible for Medicare. Most members are eligible because they’re 65 or older. These people are “aging in” to Medicare. Some members under 65 years old may be on Medicare due to a disability.

Disability

Members will automatically join Medicare parts A and B if they have been receiving disability benefits from Social Security for 24 months.

When should I sign up for Medicare?

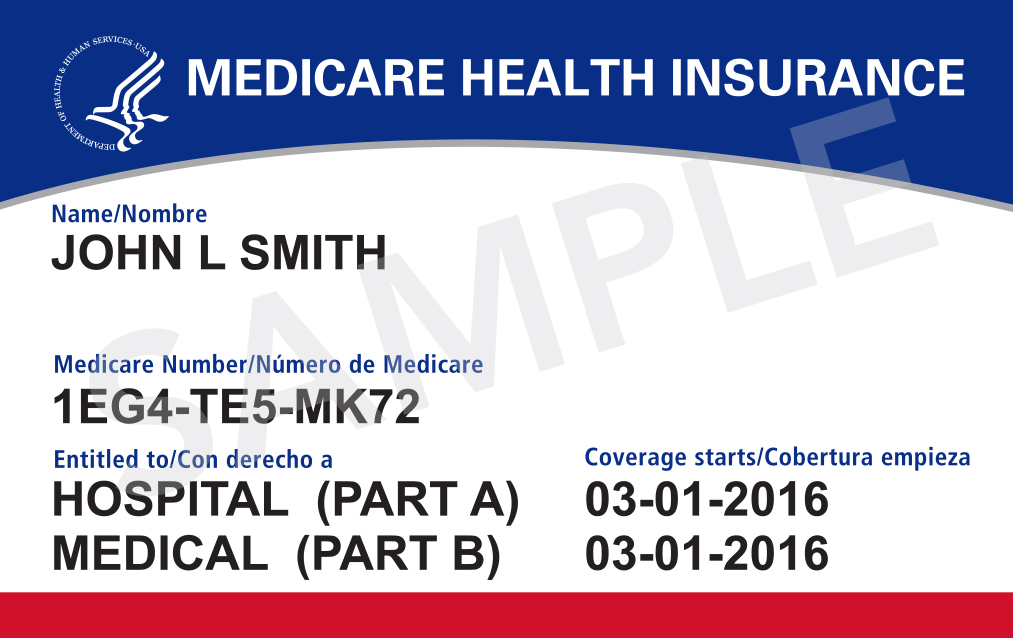

You will be automatically signed up for original Medicare (Parts A and B) on the 25th month of your disability. You should receive the ID card around the 22nd month of your disability, with an effective date of the 25th month of your disability.

Medicare Supplement vs. Medicare Advantage – At this time in Nevada, Medicare Supplement plans are not available to those under 65 on Medicare due to a disability. However, there are excellent Medicare Advantage plans available. Some with no co-pays for the primary care provider, and dental and vision included. Many plans have a level of benefit on par with Platinum plans and for no premium. Almost all also include prescription drug coverage.

Turning 65

Those aging into Medicare may or may not be automatically enrolled in Medicare. In general, if you’re currently taking social security they will automatically enroll you into parts A and B. If you’re not taking social security you may be automatically enrolled in part A or not enrolled at all. This is the general rule, but errors are frequent. If you’re still working or not planning on joining Medicare right away, it’s important to cancel your enrollment if you’re automatically enrolled. Your enrollment into part B places a time limit on enrolling in other coverage. When you’re ready to move forward with part B it’s recommended that you enroll in the rest of the coverage options at the same time. This may include either a Medicare Supplement with part D or a Medicare Advantage Prescription Drug Plan (MAPD).

When should I sign up for Medicare?

3 months before your 65th birthday it’s a good idea to log in to SSA.gov and apply for parts A and B. You can usually complete the entire process online. Once you receive your ID card, it’s important to timely enroll in other coverage. Options include either a Medicare Supplement with part D or a Medicare Advantage Prescription Drug Plan (MAPD).

Over 65

As our workforce is getting older many people are continuing coverage through their job past their 65th birthday. Also, many couples may have an older spouse who will continue coverage through their job in order to cover the younger, non-medicare eligible spouse as a dependent. If the older worker were to drop coverage and move on to Medicare, unfortunately, the younger spouse would not be able to be covered through the worker’s employer.

This leaves many individuals in their late 60’s and early 70’s signing up for Medicare for the first time. Timing is absolutely critical at this point.

If it’s your first time signing up for Medicare part B, regardless of your age over 65, you have the same guaranteed issue rights. This means if you enroll timely medicare supplement plans cannot ask you health questions. The important part is if it’s been more than 6 months after you’ve signed up for part B, medicare supplement plans can ask you health questions.

When should I sign up for Medicare?

The enrollment process is similar to those turning 65 except for one extra step. You’ll need a Certificate of Creditable Coverage from your employer. Once you have the notice, the next step is to contact the Social Security Administration. They may ask for this notice. This is your proof from your employer that you’ve had medical and prescription drug coverage that’s “at least as good” as Medicare. Most group health plans meet this requirement. This avoids the late enrollment penalty for part B and part D. You can usually use the same form to prove the coverage ended, making you eligible to enroll outside of the General Enrollment Period (Jan 1 to Mar 31st).

The next steps are almost identical to turning 65. It’s ideal if you’re able to log in to ssa.gov and complete as much of your application online as possible. They may need you in the local social security office to prove your Certificate of Creditable Coverage is valid. Once you receive your ID cards it would be the same process of timely enrolling in other coverage. Options include either a Medicare Supplement with part D or a Medicare Advantage Prescription Drug Plan (MAPD).

If you’re over 65 and enrolling in Medicare for the first time, it’s important that you work with a broker. Experienced brokers could save you thousands. Enrolling late into part B and D comes with penalties. Members who enroll outside of the guaranteed issue period for Medicare Supplement plans are frequently denied. Working with an experienced broker can avoid all of these problems.