Ultimate Guide to Medicare in Nevada

Signing up for Medicare in Nevada is confusing. This guide is designed to explain all the various plans and parts that are available to you. This includes both Medicare Supplement information as well as Medicare Advantage information.

Our way of simplifying this process is why our office is so highly rated by people looking for Medicare coverage:

Here are the parts of Medicare you need to understand.

- Part A

- Part B

- Medicare Supplement Plans

- Part D Drug Plans

- Part C Medicare Advantage Plans

1. Part A

The first part is Part A which is hospital coverage.

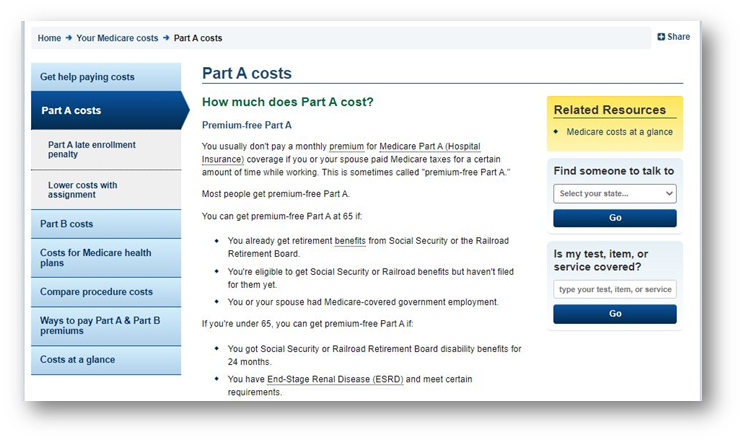

This is the first part your get from the government. Most people are eligible for Part A for no monthly premium. The “monthly premium” is another name for the monthly cost.

Part A has no premium if:

- You have retirement benefits from the Social Security

- You’re eligible for Social Security

- You had Medicare-covered government employment

- You’re on disability for 24 months

- You have End-Stage Renal Disease

If you don’t qualify for “premium-free” Part A, it can also be purchased. More information can be found here regarding buying part A.

- How do I enroll in Part A?

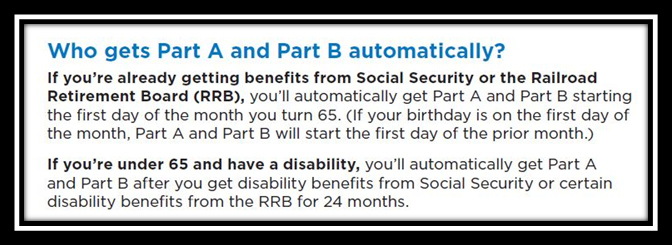

You will often be automatically enrolled in Part A by the social security administration.

PRO TIP – It’s a good idea to call the social security administration or log in online to make sure your enrollment is processing.

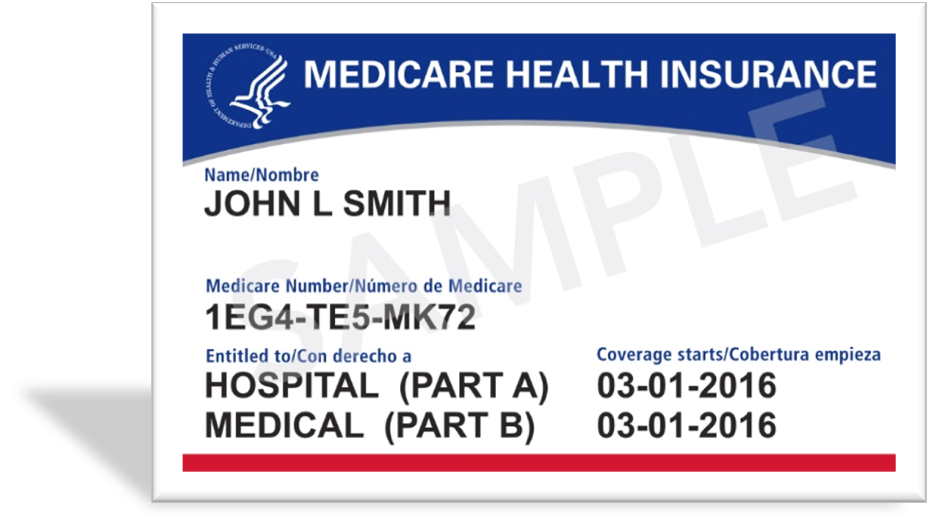

Keep an eye out for your Medicare card to arrive in the mail. You will also often get a letter from the SSA explaining your enrollment.

The card should look like this:

Part A covers 80% of your hospital expenses. Just having Part A will leave you with a very large gap in medical coverage. We’ll cover this in more detail below.

The next step is to get Part B from the Social Security Administration

2. Part B

Part B is the second and final part that you get from the federal government.

This part covers doctor visits and other items not covered under Part A.

Unlike Part A, Part B DOES have a premium (monthly cost).

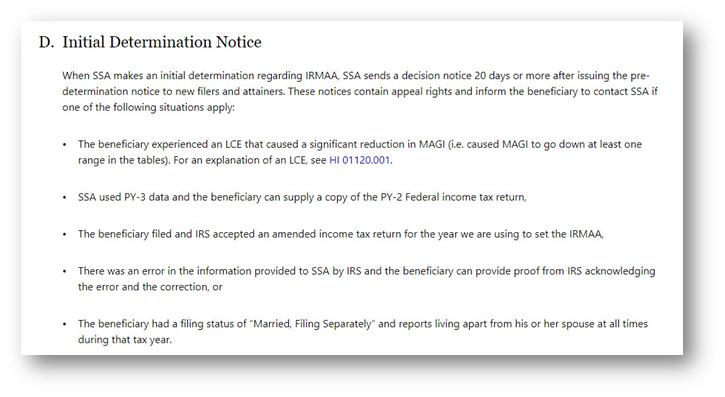

The cost of Part B will depend on how the SSA determines your income or IRMAA (Income Related Monthly Adjustment Amount).

The SSA will look at your income from two years ago to determine how much they will charge you for Part B.

Here is a chart that shows the costs for 2026:

It is very important to review these amounts. If you are even 1 cent over a lower income bracket, you might have to pay significantly more in premiums over the course of the year.

You can also file an appeal to the SSA if your income has changed drastically in the last year. This might help to significantly lower the cost of your IRMAA.

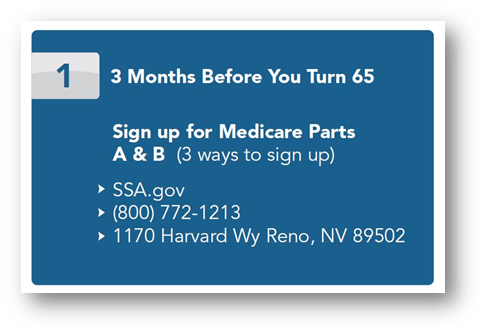

Unlike Part A, most people will need to actively enroll in Part B. The best time to do this is 3 months before your 65th birthday.

You can sign up for Part B online, over the phone, or at your local SSA office.

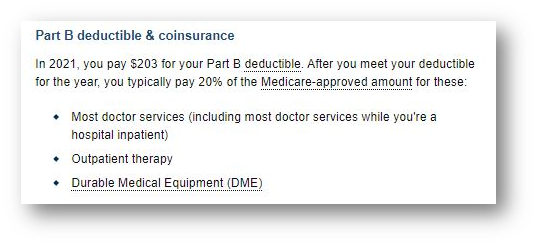

Just like Part A, Part B only covers 80% of your doctor’s expenses, and neither Part A nor B cover prescription drugs so you will want to enroll in supplemental coverage.

You can do this once you have confirmation of both parts.

Let’s look at your options from here.

3. Medicare Supplement Plans

A Supplement Plan is one option to help fill in the gap of Original Medicare A and B.

You enroll in a Supplement Plan with a private insurance company and the insurance company works with Medicare to pay for most of your medical services.

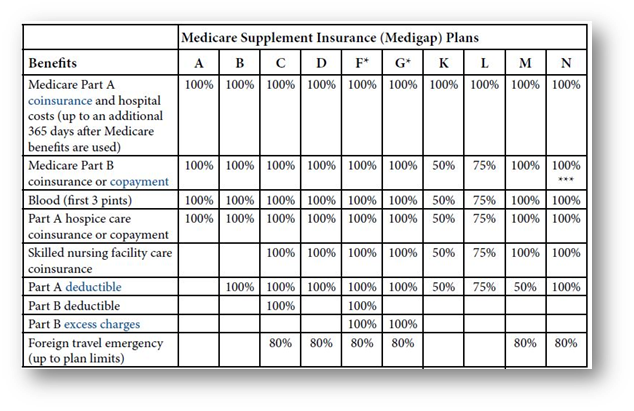

There are many different Medicare Supplement plans like G, F, N, B, etc. These plans are not the same as Parts A and B.

You often hear Supplement plans referred to as Medigap plans. These two terms are the same thing.

There are two main reasons why someone chooses a Medicare Supplement plan over the other option.

- It has very low out of pocket expenses. Typically, the biggest portion of your out of pocket is the Part B deductible.

- It covers any doctor in the U.S. that accepts Medicare.

- The Supplement plan would cover the majority of the 20% listed above.

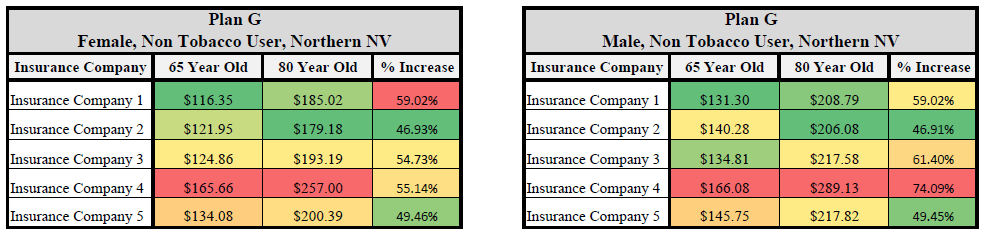

Medicare Supplement plans have a premium you must pay to be a member of their policy. The premiums are dependent on a variety of factors such as age and county of residence.

The premium does not include your premium for Part B.

You still pay the Part B premium no matter which Medicare plan you choose.

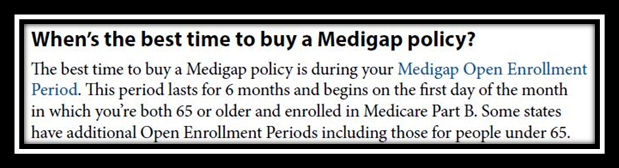

The best time to apply for a Supplement Plan is when you initially turn 65 or when you sign up for Part B.

You will not need to answer health questions or go through underwriting if you enroll at this time.

If you miss this window, you may have to answer health questions. Based on your answers, the insurance company may charge you a higher premium or deny your application. You can apply at any time.

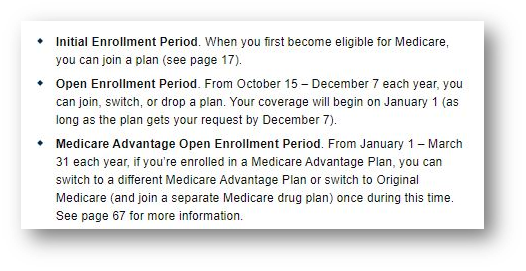

Medicare Supplement plans do not have an annual enrollment period. The annual enrollment period only applies to Medicare Advantage and Prescription Drug Plans.

Medicare Supplement Plans are identical from one carrier to the next in terms of out-of-pocket expenses and doctor choice. The biggest difference is the monthly premium and how much that premium increases over time. Here is an example:

Since Medicare Supplement plans do not have drug coverage, you will need to enroll in a separate drug plan.

4. Part D Drug Plans

A drug plan is a separate policy designed to just cover prescriptions. If your Medicare plan does not have drug coverage, you will need one of these policies.

There are two major consequences if you do not sign up for a drug plan.

- If you need to fill a prescription during the year, you will need to pay entirely out of pocket.

- If you do not have any drug coverage while on Medicare, you can be penalized.

Here is the penalty calculation from Medicare’s website: Part D Penalty

Fortunately, there is an easy way to enroll in Part D Plans.

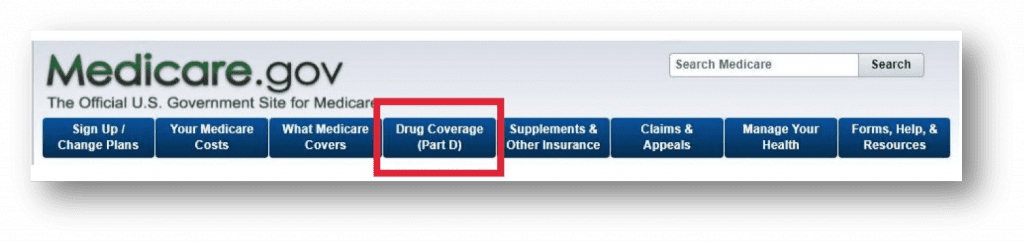

First, go to medicare.gov

Next, hover over the “Drug Coverage (Part D)” button and select “How to get prescription drug coverage”

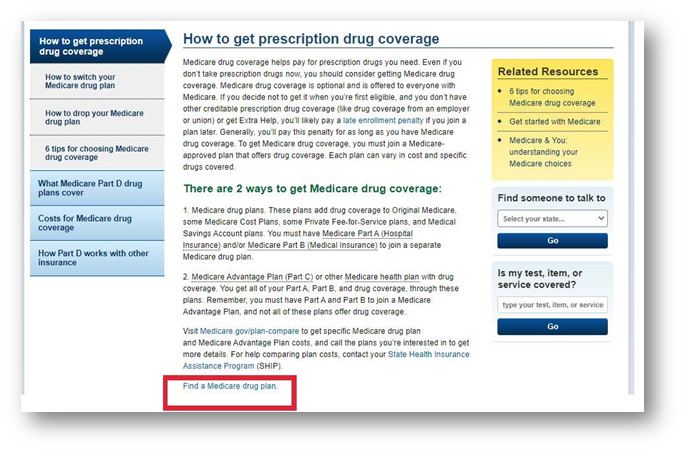

On the next page click “Find a Medicare drug plan”

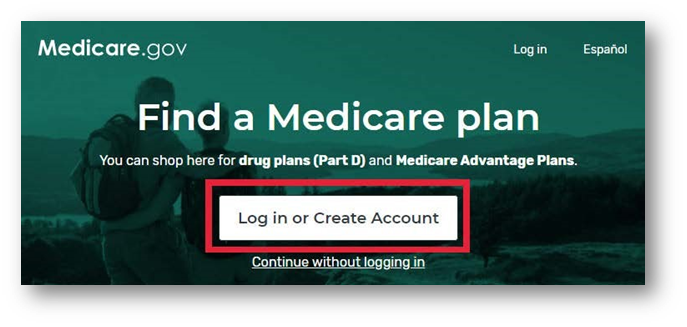

You should then create an account on medicare.gov to save all the information you will enter.

Once you have created an account, it is time to shop for a plan. On the account homepage, you click “My Providers and Services” and then click on “Update My Drugs and Pharmacies”

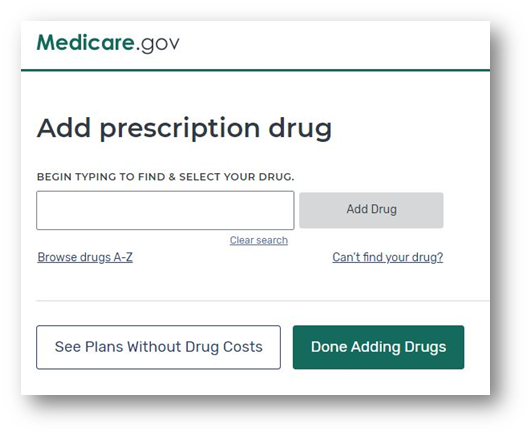

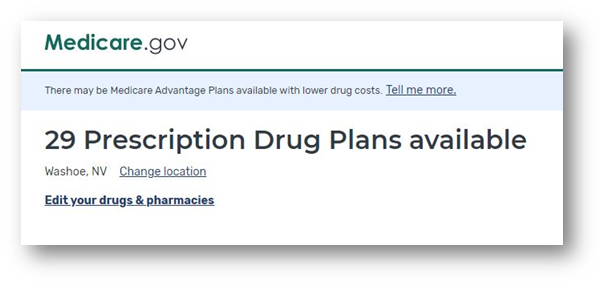

The next page should look like this:

After you have entered your drugs and dosages, click “Done Adding Drugs”.

Once you have clicked that then you should land on the pharmacy page that looks like this:

Select your preferred pharmacies and then click done in the bottom right corner.

You will now see this message as well as a list of multiple different drug plan options that are available in your area.

Our office suggests selecting the top plan on that list. That is the plan that Medicare is estimating to be the best deal for your prescriptions and pharmacy.

You can even click the green “Enroll” button to sign up for the policy right on Medicare’s website.

Here is a link to a YouTube video on how to do the above steps: https://youtu.be/iv-2bOtcp8Y

There are certain plans that may have drug coverage already in the policy.

These policies are called Medicare Advantage.

5. Part C Medicare Advantage Plans

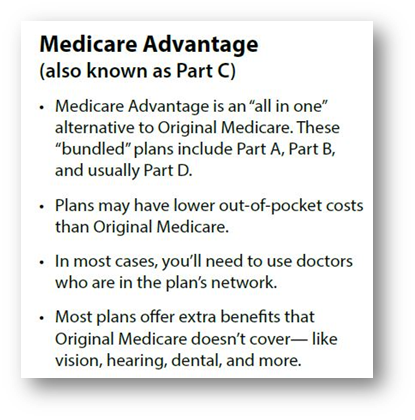

A Medicare Advantage plan is described by the government as an all in one package. It combines medical, drug, and extra benefits like dental and vision under one single policy.

Many Medicare Advantage plans in Nevada have $0 monthly premiums. There is no extra charge to be a member as long as you keep paying your Part B premium.

Since these plans do not have a premium and include all the parts of Medicare and extra benefits you would need, they are great options for saving money.

You can sign up for Medicare Advantage plans when you turn 65, during the annual enrollment period, or if you experience certain life events.

If you decided to enroll in an Advantage plan, it is very important that you understand the change you are making. You can often end up terminating your current policy by making this election.

Changing your plan may have an effect on what doctors and facilities your plan will cover. These plans are only contracted with certain physicians.

You also cannot enroll in a separate drug plan if you are enrolled in a Medicare Advantage plan.

You’re a Medicare Expert Now

If you made it this far, you should now have a great grasp of the various plans and parts of Medicare in Nevada. Feel free to call our office with questions or help with your Medicare plan. This is a great way to ensure you are getting the best deal and benefits.

Sources:

Hometown Health/Senior Care Plus: https://www.seniorcareplus.com/

Prominence Medicare: https://prominencemedicare.com/

Official U.S. Government Site for Medicare: https://www.medicare.gov/

Center for Medicare & Medicaid Services: https://www.cms.gov/