What are the different Health Insurance Options available to you?

There are three main options when choosing a Health Insurance Plan:

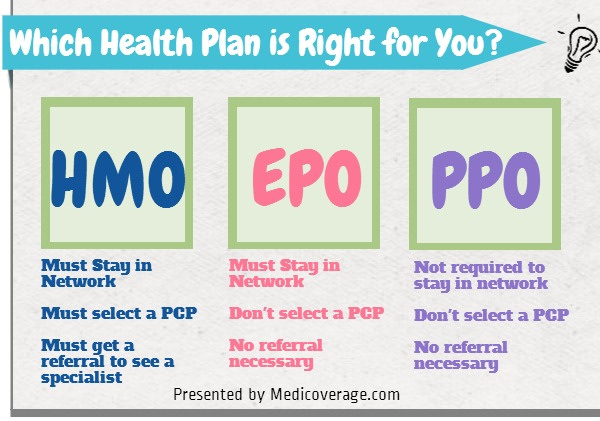

- HMO- Health Maintenance Organization

- EPO- Exclusive Provider Organization

- PPO- Preferred Provider Organization

HMO:

Pros: The HMO plan is the most cost effective plan when compared to the other two options.

Cons: Under the HMO plan, you are required to establish a Primary Care Physician within the network. Also, if you want to see a specialist, a referral from your PCP is required. This is the most restrictive plan.

EPO:

Pros: Unlike the HMO plan, there is not a requirement to have a Primary Care Physician in network. So people living in more rural areas do not need to establish a Primary Care Physician, which can be quite an advantage. There is also no referral requirement to see a specialist!

Cons: The EPO plan is more expensive than the HMO plan. You also receive no out of network benefits like the PPO plan, which can be limiting when looking for healthcare.

PPO:

Pros: Just like the EPO plan, you don’t need to be established with a Primary Care Physician. With a PPO plan, there is the most freedom in choosing your providers, because you have out of network coverage. PPO plans can be a great option for people living in rural areas due to its flexibility with its out of network provider list.

Cons: The PPO plan is the most expensive plan.

Final Thoughts:

Every person is different, every persons situation is different. Because of this, health insurance is not one size fits all and choosing your health insurance plan should be tailored to you. If you need any help with navigating your health insurance, please call us today at (775)-828-1216! We have a team of health insurance advisors waiting to help you choose the right plan.