New babies are little bundles of joy – extremely expensive little bundles of joy. Health insurance is supposed to help with the cost. However, if it’s not purchased correctly or used correctly, it won’t work. This could leave new parents with unbelievable expenses. It can be difficult to find the best Nevada health insurance for newborns. In this article, I’ll review the best way to purchase the best Nevada health insurance for newborns. Below I review how to analyze the different plan options. I also recommend a few that cover doctors in Northern Nevada, but this analysis can be done with any plan anywhere. Some common mistakes, and how to avoid them, are included at the end.

In this article, I’ll review the best way to purchase the best Nevada health insurance for newborns. Below I review how to analyze the different plan options. I also recommend a few that cover doctors in Northern Nevada, but this analysis can be done with any plan anywhere. Some common mistakes, and how to avoid them, are included at the end. Here in Nevada, it’s called the Nevada Division of Insurance. Using this site you can see all Qualified Major Medical Plans.

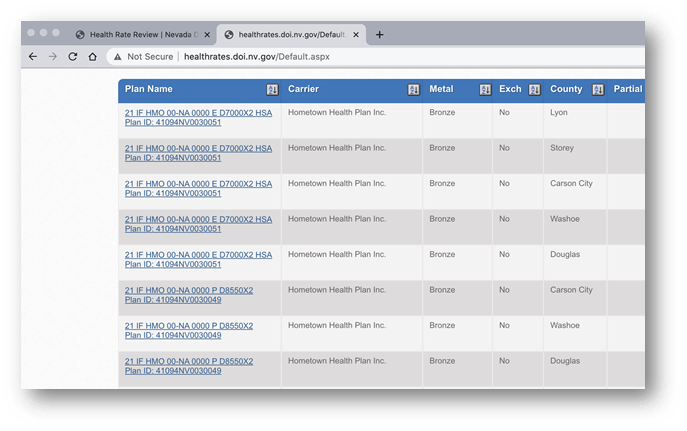

Here in Nevada, it’s called the Nevada Division of Insurance. Using this site you can see all Qualified Major Medical Plans.  Why is it important to buy a Qualified Major Medical plan? – Many people have a bad opinion about health insurance because they purchased a cheap policy, (think the one with the duck). Those are not Qualified Major Medical insurance plans. With that type of policy, the carrier only reimburses you a small amount. Qualified Major Medical plans COVER the expense. You still may be responsible for deductibles and copayments (more details further on) but otherwise, this is dramatically different than a small reimbursement. Don’t just go to this site, sort by the cheapest plan, and buy it. That’s not a good strategy – read on.

Why is it important to buy a Qualified Major Medical plan? – Many people have a bad opinion about health insurance because they purchased a cheap policy, (think the one with the duck). Those are not Qualified Major Medical insurance plans. With that type of policy, the carrier only reimburses you a small amount. Qualified Major Medical plans COVER the expense. You still may be responsible for deductibles and copayments (more details further on) but otherwise, this is dramatically different than a small reimbursement. Don’t just go to this site, sort by the cheapest plan, and buy it. That’s not a good strategy – read on.  The 10 essential health benefits are required to be covered by all Qualified Major Medical Plans. If the plan is listed on the state insurance website, it includes these. You’ll notice pregnancy is specifically listed. Other related services that may have to do with pregnancy are also listed – lab services, hospitalization, ER services, prescriptions, ambulatory patient services (diagnostic imaging)… Don’t fall into the trap of thinking all plans include these 10 essential services, they don’t.

The 10 essential health benefits are required to be covered by all Qualified Major Medical Plans. If the plan is listed on the state insurance website, it includes these. You’ll notice pregnancy is specifically listed. Other related services that may have to do with pregnancy are also listed – lab services, hospitalization, ER services, prescriptions, ambulatory patient services (diagnostic imaging)… Don’t fall into the trap of thinking all plans include these 10 essential services, they don’t.  Find the doctor you need on this list. Don’t fall into the trap “The doctor takes my Anthem plan through my work – This is Anthem too” No, your company plan through work reimburses the doctor a lot more. That means your doctor can say, yes, he accepts that Anthem plan but no, he doesn’t take this one. Check your doctor.

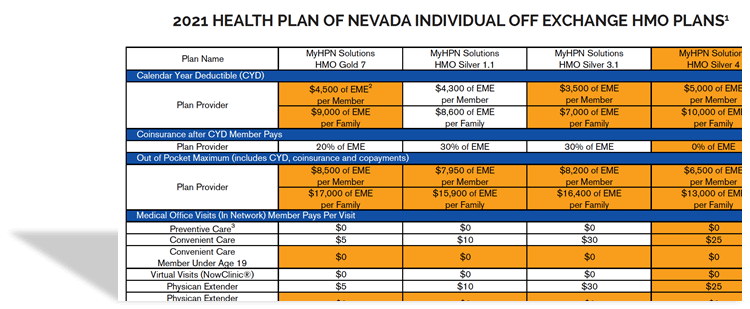

Find the doctor you need on this list. Don’t fall into the trap “The doctor takes my Anthem plan through my work – This is Anthem too” No, your company plan through work reimburses the doctor a lot more. That means your doctor can say, yes, he accepts that Anthem plan but no, he doesn’t take this one. Check your doctor.  This can be an easy way to compare which plan is going to work for you. You can usually find this by going to the insurance company’s website and digging around. A health insurance broker can also send you this information for free. Brokers will also be able to provide quotes from multiple companies. This is not available by going directly to the insurance company’s website. Usually, buying up to a more expensive plan is almost always worth it. Especially if you know you’ll be using it. If you’re buying health insurance to cover a new baby, you’ll likely be using it. Don’t think that only sick children use the health insurance plan. Even the healthiest children will still use medical services.

This can be an easy way to compare which plan is going to work for you. You can usually find this by going to the insurance company’s website and digging around. A health insurance broker can also send you this information for free. Brokers will also be able to provide quotes from multiple companies. This is not available by going directly to the insurance company’s website. Usually, buying up to a more expensive plan is almost always worth it. Especially if you know you’ll be using it. If you’re buying health insurance to cover a new baby, you’ll likely be using it. Don’t think that only sick children use the health insurance plan. Even the healthiest children will still use medical services.  This can give you an idea of the cost of the service, but please keep in mind this only gives you a rough idea.

This can give you an idea of the cost of the service, but please keep in mind this only gives you a rough idea.

In this article, I’ll review the best way to purchase the best Nevada health insurance for newborns. Below I review how to analyze the different plan options. I also recommend a few that cover doctors in Northern Nevada, but this analysis can be done with any plan anywhere. Some common mistakes, and how to avoid them, are included at the end.

In this article, I’ll review the best way to purchase the best Nevada health insurance for newborns. Below I review how to analyze the different plan options. I also recommend a few that cover doctors in Northern Nevada, but this analysis can be done with any plan anywhere. Some common mistakes, and how to avoid them, are included at the end.1. Purchase only health insurance plans certified by the Nevada Division of Insurance.

Here in Nevada, it’s called the Nevada Division of Insurance. Using this site you can see all Qualified Major Medical Plans.

Here in Nevada, it’s called the Nevada Division of Insurance. Using this site you can see all Qualified Major Medical Plans.  Why is it important to buy a Qualified Major Medical plan? – Many people have a bad opinion about health insurance because they purchased a cheap policy, (think the one with the duck). Those are not Qualified Major Medical insurance plans. With that type of policy, the carrier only reimburses you a small amount. Qualified Major Medical plans COVER the expense. You still may be responsible for deductibles and copayments (more details further on) but otherwise, this is dramatically different than a small reimbursement. Don’t just go to this site, sort by the cheapest plan, and buy it. That’s not a good strategy – read on.

Why is it important to buy a Qualified Major Medical plan? – Many people have a bad opinion about health insurance because they purchased a cheap policy, (think the one with the duck). Those are not Qualified Major Medical insurance plans. With that type of policy, the carrier only reimburses you a small amount. Qualified Major Medical plans COVER the expense. You still may be responsible for deductibles and copayments (more details further on) but otherwise, this is dramatically different than a small reimbursement. Don’t just go to this site, sort by the cheapest plan, and buy it. That’s not a good strategy – read on. 2. Make sure your plan includes the 10 essential health benefits.

The 10 essential health benefits are required to be covered by all Qualified Major Medical Plans. If the plan is listed on the state insurance website, it includes these. You’ll notice pregnancy is specifically listed. Other related services that may have to do with pregnancy are also listed – lab services, hospitalization, ER services, prescriptions, ambulatory patient services (diagnostic imaging)… Don’t fall into the trap of thinking all plans include these 10 essential services, they don’t.

The 10 essential health benefits are required to be covered by all Qualified Major Medical Plans. If the plan is listed on the state insurance website, it includes these. You’ll notice pregnancy is specifically listed. Other related services that may have to do with pregnancy are also listed – lab services, hospitalization, ER services, prescriptions, ambulatory patient services (diagnostic imaging)… Don’t fall into the trap of thinking all plans include these 10 essential services, they don’t. 3. Pick the right insurance company.

Out of the insurance companies listed on the state website, which one is the best Nevada health insurance for newborns? Is the cheapest one the best? Why do the plan names look like they’re all in some code? Start small – first pick the insurance company. The first step is to find out if the doctor you need (or at least a good list of doctors) accepts the insurance. If you dive into the details of each plan, you will be able to find the “Provider and Rx Links”. Find the doctor you need on this list. Don’t fall into the trap “The doctor takes my Anthem plan through my work – This is Anthem too” No, your company plan through work reimburses the doctor a lot more. That means your doctor can say, yes, he accepts that Anthem plan but no, he doesn’t take this one. Check your doctor.

Find the doctor you need on this list. Don’t fall into the trap “The doctor takes my Anthem plan through my work – This is Anthem too” No, your company plan through work reimburses the doctor a lot more. That means your doctor can say, yes, he accepts that Anthem plan but no, he doesn’t take this one. Check your doctor. 4. Evaluate which plan is the best for newborns.

Plans are not all treated the same. Even though all of them cover the 10 essential health benefits, it doesn’t mean they cover it for no cost to you. Bronze plans are the least expensive per month, but most expensive to see the doctor. Gold and Platinum plans are just the opposite. Many plans have a side-by-side comparison they’ll show you through their website. This can be an easy way to compare which plan is going to work for you. You can usually find this by going to the insurance company’s website and digging around. A health insurance broker can also send you this information for free. Brokers will also be able to provide quotes from multiple companies. This is not available by going directly to the insurance company’s website. Usually, buying up to a more expensive plan is almost always worth it. Especially if you know you’ll be using it. If you’re buying health insurance to cover a new baby, you’ll likely be using it. Don’t think that only sick children use the health insurance plan. Even the healthiest children will still use medical services.

This can be an easy way to compare which plan is going to work for you. You can usually find this by going to the insurance company’s website and digging around. A health insurance broker can also send you this information for free. Brokers will also be able to provide quotes from multiple companies. This is not available by going directly to the insurance company’s website. Usually, buying up to a more expensive plan is almost always worth it. Especially if you know you’ll be using it. If you’re buying health insurance to cover a new baby, you’ll likely be using it. Don’t think that only sick children use the health insurance plan. Even the healthiest children will still use medical services. What do you look at when you’re comparing the best Nevada health insurance for newborns?

Each plan will include a Summary of Benefits and Coverage (SBC). It will show examples of costs for common medical services. One of these medical services is having a baby. These are standard. Every insurance company has to include one, and it has to be in this exact same format. This can give you an idea of the cost of the service, but please keep in mind this only gives you a rough idea.

This can give you an idea of the cost of the service, but please keep in mind this only gives you a rough idea.