What is a health insurance broker?

A health insurance broker helps you find the right health plan for your needs. There are often numerous different options in your area and knowing the latest ins and out of each plan is very difficult for consumers.

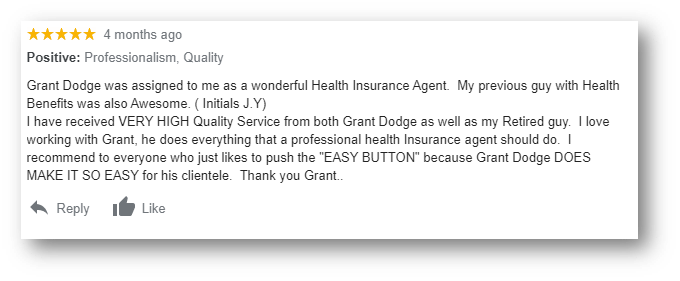

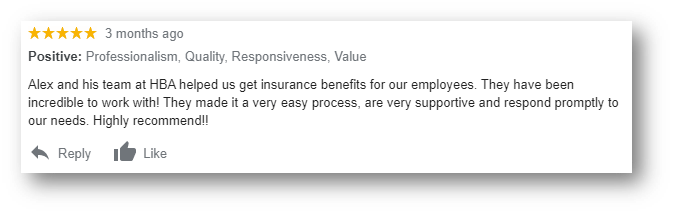

This is where a health insurance broker can be an invaluable resource. Here is what some people had to say about our services.

Here are some more reviews:

You can read the remainder of our reviews here: Google Reviews

So What Are You Getting With an Insurance Broker?

A no-cost professional on your side to help you find the right plan for your needs. You do not pay any more than you normally would for the health plan when you use a broker.

Our office is contracted with every insurance carrier in Nevada. We shop each plan for you and present you with the best options for your situation. We also manage your plan for you and are a constant resource for help with potential problems with your policy.

The insurance industry is not consumer-friendly. You often have to comb through confusing documents like this to even have a basic understanding of the health plan:

This is one page from a Summary of Benefits for one health insurance plan. There are about 15 pages total in each summary of benefits and each carrier offers anywhere from 10 to 30 different plans!

Rather than reading through each plan ANNUALLY, you can have someone that knows these plans by heart explain the most important parts for your needs.

The reason we are a no-cost resource

It may sound too good to be true but our services cost nothing for you to use.

he insurance company pays us to administer your plan. Therefore, you would pay the exact same amount if you found a plan on your own as opposed to using us.

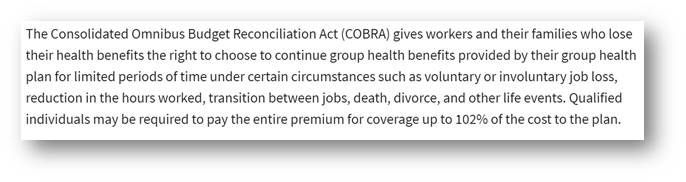

In fact, we will often suggest plans that compensate us nothing. Such as COBRA:

Or Medicaid:

By adding us as your health insurance broker, you will avoid taking the time to try and work through the confusing plans and process to only end up missing some key information.

How Do You Start the Process of Comparing Health Plans?

Our office created a tool on our website for you to compare individual plans. You will only be contacted by someone from our office if you use this. Your information is never shared.

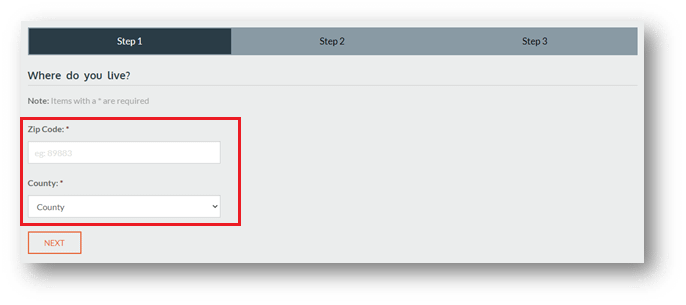

The first step is to go to healthbenefits.ocglabs.com. Then click the “Individual and Family Quote” button:

Next, enter your zip code. The county field should already populate but double-check it for accuracy.

If we are outside of that time period, we will need a life event to sign up. We can walk you through the process of proving a life event.

Once you have clicked next, you will land on this page below which is the final step.

Enter your information and click the “See Plans Button”. You will be able to see different plans and rates that are offered in your area.

Group Health Insurance

If you are a business owner or you are responsible for your company’s health insurance benefits, then a broker will be an invaluable partner.

Here are the main services that our brokerage provides for a business.

- We shop every plan for you and your business

- Constantly looking out for new changes in the market, such as Association Health Plans

- Walk you through each step of the installation process

- Handle all new enrollments and terminations after the group is installed

- We offer a 100% complementary online enrollment system for your employees. This makes the enrollment process for each employee easier than it has ever been.

- Constant resource all year long. We are happy to speak and resolve any problems with employees directly should a problem occur.

- We send you contribution reports so you know exactly how much the company and the employees are paying for the health plan and how often for payroll deductions.

If you currently have a group plan ad you want to see some other options or you would like to start a group plan then you can click the group quote button on our homepage.

We can also provide our services for when you turn 65

Our services do not stop with individual or group health plans. As your health insurance broker, we can also help you transition to Medicare.

Medicare is a completely different ballgame when you are coming from a group or individual plan. If you are turning 65 or you are eligible for Medicare due to a disability, we want to help.

You can learn some of the basics by going to our Medicare webpage. If you feel like reading some more, head over to our Ultimate Guide to Medicare to get some in-depth information.

You can also get quotes for Medicare plans by going to our Medicare page and clicking the “Medicare Quote” button.

In a nutshell, here are the steps to get completely signed up for Medicare.

- Get Parts A and B from the Social Security Administration

- Decide if you want a Medicare Supplement or Medicare Advantage plan with a health insurance broker

- Enroll in a Part D drug plan if needed

Here is a graphic that shows this process:

Medicare is constantly changing and what plan you had last year may not be the best option for you this year. This is why developing a relationship with a health insurance broker is crucial.

Our office reviews each plan annually to find out where the best choices are. We then reach out to every client to let them know what the changes are and if we recommend switching.