Top 10 Things When Enrolling In Nevada Medicare

Medicare can be confusing. There are so many different parts and plans that people often get these mixed up. Below is a list of the top 10 things to know when you are enrolling in Nevada Medicare.

#1 What is the coverage??

There are two different parts to Original Medicare.

Part A- This covers hospitalization, in patient services, and hospice.

Part B- This covers your out-patient procedures, doctor visits, and medical equipment.

Parts A and B of Original Medicare will cover 80% of your approved medical costs. You are responsible for the remaining 20%. Don’t worry! We have solutions for that remaining 20%! More on that later.

#2 When Can I Sign Up?

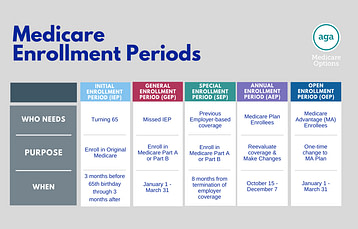

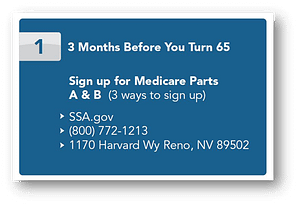

There are many enrollment periods when it comes to Medicare. Let’s start with the basics. Medicare allows you to sign up for Parts A and B starting 3 months before your 65th birthday, the month of your 65th birthday, and ends 3 months after your 65th birthday.

This enrollment period is called the Initial Enrollment Period.

If you are still on your group health plan after turning 65 then you may qualify for a Special Enrollment Period when you go to retire and drop off of their benefits. Your Special Enrollment Period begins when your either:

1- Your employment ends

2- Your group health insurance drops you after your employment ends.

After that you have an 8 month enrollment window!

#3 Pick the Plan That Best Fits Your Needs

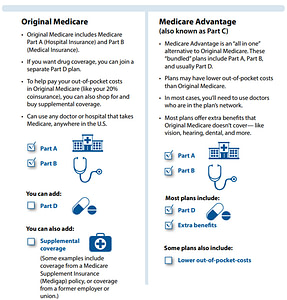

There are two different types of insurance offered by private companies that will cover your 20%. Medicare Supplement (Medigap) and Medicare Advantage (Part C).

Most Medicare Advantage plans in the State of Nevada come with low out of pocket costs! Their premiums are typically very low and the plans are usually made up of copays.

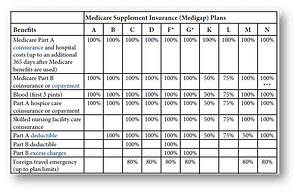

The other side of Medicare is with Medicare Supplement plans. This is where you will see the word Plans (instead of parts). These policies come with a premium but provide great benefits.

(Chart of Supplement Policies)

The most popular plan is Plan G. It covers 100% of approved medical services once you satisfy the Part B Deductible of $203 (For 2021). If you are interested in either one of those policies you can click here to learn more!

#4 Know your out of Pocket Costs

Both Medicare Supplement and Medicare Advantage policies both offer different out of pocket maximums. Let’s take a look at the Medicare Supplement side of things first.

On the plan we recommend (Plan G), after the premiums are paid, the out of pocket cost that you need to worry about is only $203 as mentioned above. That’s the Part B Deductible. After that, 100% of approved Medicare services are covered. To learn more about Medicare Supplement plans click here.

Medicare Advantage has multiple parts to its out of pocket costs. As far as premiums go, most Medicare Advantage companies have a $0 premium. These plans are primarily made up of copays and the out of pocket costs can vary company to company. To learn more about Medicare Advantage plans click here

#5 Check the Network List

Now both Medicare Advantage and Medicare Supplement plans have different lists as far as who you can see. The big thing to check when looking at these plans is going to be who your doctors currently are.

With Medicare Advantage, you are limited to the network list of the carrier. They will determine who you can and cannot see so be sure to look at these lists before you sign up with a carrier.

Medicare Supplement looks a little different. When looking for doctors on a Medicare Supplement plan you do not have to look at the individual carriers. As long as the doctor accepts Original Medicare, then they accept a Medicare Supplement. Since Medicare Supplement policies are regulated by the federal government, you will need to check Medicare.gov for approved doctors.

#6 Check the Drug Formulary

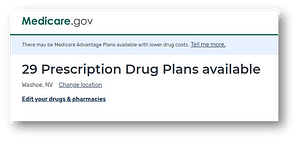

This is going to look different, once again, for Medicare Advantage and Medicare Supplement. Let’s start with Medicare Advantage. Most Advantage plans come with a part D drug plan attached. This provides a huge convenience to the client. It is very similar to the network list point I made above. Make sure to look at the prescriptions you take and double check them with the list the carrier provides.

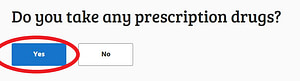

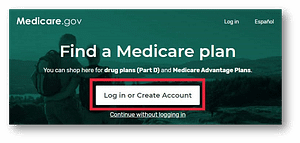

Medicare Supplement plans do not actually have drug plans attached to them. This is where we recommend our clients to visit the Medicare.gov website and purchase a drug plan there. This website is extremely user friendly and saves your prescriptions year to year.

#7 Picking the Right Drug Plan

This goes hand in hand with what I wrote above about Medicare Supplement plans. Medicare.gov is a great tool to use when looking for a drug plan. Simply create an account, enter your prescriptions, enter the pharmacy you like to go to, and the site will do the rest. Sounds easy right? Watch our YouTube video below for a step by step instruction on how to create your account.

#8 You Are Not Stuck With Your First Option

The great news is you are not stuck with your first option. Every year from October 15th to December 7th, you are allowed to shop Medicare Advantage plans and can make a switch with the effective date of January 1st of the next year. The Annual Enrollment period is where you can switch from company A to company B with no hassle at all. Make sure to shop around each year so you know you have the best option available. To see the difference and the different parts of Medicare, check out this article.

#9 Sign up Early

Make sure to sign up early when looking in to Medicare. There are plenty of people turning 65 every month and that can back up Social Security when trying to get everyone’s cards out. Our suggestion is to sign up for Medicare Parts A and B at least 3 months prior to turning 65. This will allow you plenty of time to get your card and start shopping for coverage.

#10 Get a Professional to Help

This is what we are here for. Getting someone in to the right Medicare plan is something we do on a daily basis. So call your local broker, hopefully us, and let us do the heavy lifting for you. Medicare can be a very confusing world and if you are not careful, you could get put in to the wrong plan. Avoid the headaches with and contact one of our local health insurance brokers to help you find the plan that best fits your needs.

That wraps up our Top 10 things to know when enrolling in Nevada Medicare. Be sure to check out our website to get in touch with a broker and our Youtube page for more info.