Open enrollment for your business health plan, also known as group open enrollment, can be a stressful time for you and your employees. In fact, it is probably the most stressful time after a group health plan is in place. There are a lot of factors to consider, and it is easy to make mistakes that can affect your employees for the next 12 months.

You should start working on your company’s renewal at least 60 days before the effective date. The sooner it gets done, the sooner your employees get their new ID cards in hand. If you need help starting a group health plan, you can do so here: Small Business Health Insurance

The First Step

Your broker should have sent you a handful of new options for the upcoming year. These options would have included the most similar plan choices to what you have today, along with various other choices with the same insurance carrier and different carriers operating in your area.

There are a handful of things to consider when comparing your options, such as:

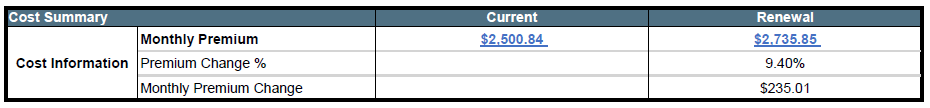

- The change in monthly premium and your budget for healthcare next year.

- The change in benefit structure such as copays and deductibles.

- What does the most similar priced plan look like? What about the plan closest in benefit?

- How will switching to a different carrier impact my employee’s access to care?

- Have my employees mentioned anything over the last year that could impact my decision?

These aren’t the only things to consider but if you are going through each of these points, then you’re on the right track.

Once you have decided on your plan choices for next year, now is the time to have your employees elect coverage.

Enrolling Your Employees

Okay, you have made a decision on your plan for next year, now what? Well, we need to get your employees signed up for the new coverage choices for next year.

There are many different ways to do this such as online or with paper handouts but one way or another, you will want to present all the new choices for your employees.

If you selected plans with the same carrier, any currently enrolled employees do not actually need to do anything if they have no changes. Employee will automatically be moved to the most similar option for the next year. Although if they want to switch plans, add dependents, change any of their personal info, etc. then now is the time to do it.

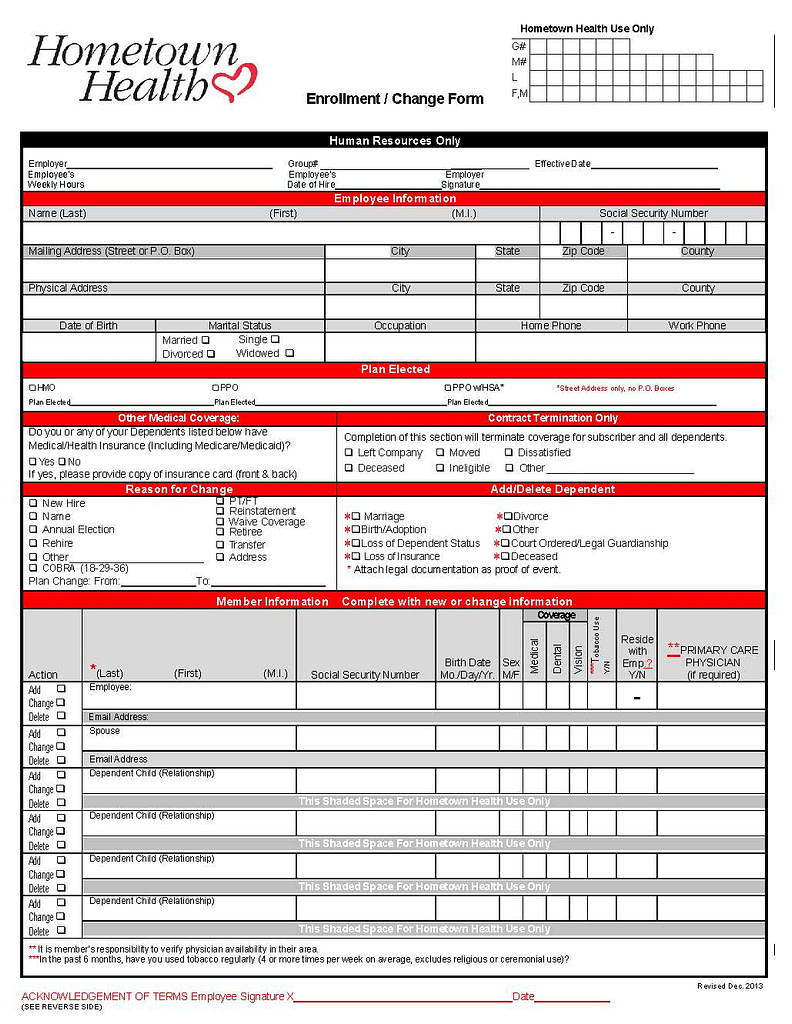

If you are going with a completely different carrier, all your employees will need to fill out new applications.

Your employees may have a lot of questions about their options or they may just want to hear a general overview of coverage. That is where your broker comes in. We encourage our clients to send all questions and comments from their employees to us directly.

Important Tip: You should make sure any employee that doesn’t want coverage signs a waiver or you at least have proof coverage was offered. This will protect you in case an employee comes back at a later date saying that it wasn’t offered.

Now that you have gathered all your enrollment forms, it’s time to send them in.

Carrier Submission

So, your employees have completed their portion of the group enrollment process. The next thing we are doing is sending everything to the insurance carrier.

If you’re going with the same insurance company, you just need to submit new employees signing up, current employees that are changing plans or demographic information, and your signed renewal elections form.

If you’re changing insurance carriers, you’ll need the following:

- Master application

- All employee enrollment forms

- Payroll reports for your employees

- Method for the first premium payment

- Any additional documents that carrier requires

Your broker should be filling out all these documents for you to the best of their knowledge. There might be some fields that they need to complete, but for the most part, you should just need to sign the forms and send them back. Keep in mind that while the carrier may require certain documents to start coverage, there are other rules you may need to follow with the ACA.

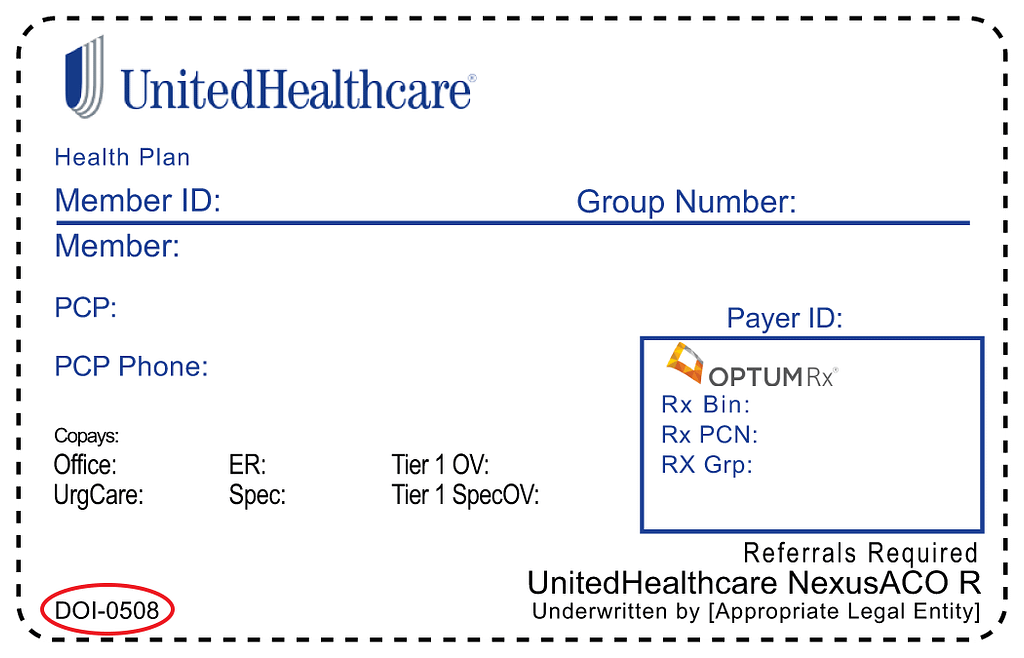

Important Tip: Many carriers have deadlines for when your allowed to submit coverage such as the 15th or 25th of the month prior to the effective date. If you miss this window, the soonest you can start coverage is the first of the next month.

Now What?

Now we wait for approval from the insurance carrier. This can take as long as 3 weeks during busy times of the year. This is why submitting your case sooner rather than later is important since your employees can be waiting quite a while for their new cards if you wait until the last minute.

Approval usually comes in the form of a welcome letter if you are new to the insurance carrier. If you are renewing with the same insurance company, you will get a completion of renewal notice.

The carrier may also come back and ask for additional documents, further delaying the completion date.

Sometimes, a carrier might be able to get you temporary ID cards for your employees while you wait for cards to arrive in the mail. These are digital cards that are identical to the physical cards but it still takes time for the carrier to generate these after you have submitted everything for your group open enrollment.

This should give you a good idea of the group open enrollment process. Keep in mind that many other issues or problems can pop up during this time. That is why it is a great idea to have a health insurance broker by your side. It doesn’t cost anything to use one and you will have someone to guide you through this entire process.