Medicare – It’s Confusing!

I hear over and over, Medicare – It’s confusing! If you are thinking, Medicare – It’s confusing you have come to the right place. If you’re in your 50’s you’re probably starting to receive Medicare marketing in your mailbox. While this can be exciting, it can also be overwhelming.

It can be exciting because you are getting close to retirement. On the other hand, it can be a daunting process. The days of not being on a set schedule are exciting for many people. Another exciting aspect of retirement is your health care costs becoming less expensive.

This may sound counterintuitive. Keep in mind that logically it makes sense that as we age, our health care costs increase. On a macro level, this is true. Many of us do need more medical care as we age. This care is expensive. Hospital bills go up, doctor bills increase.

The Cost

You might be wondering how costs can go down. Think about it. If you are on an employer plan or an individual health plan, your monthly cost has increased every year as you get older. By the time we are 64 that monthly premium can be 4 digits. At 65, however, the costs, on many Medicare plans can go down to $0!

This does not seem logical. How can this be true? These are questions I get every day from my clients aging into Medicare. Many people assume that the costs will continue to skyrocket. When I tell them, that in fact, the costs go down they oftentimes have more questions.

Original Medicare

As I sit down with a prospective client to go over the ABCs of Medicare I start with Parts A and B. A and B are known as Original Medicare. Original Medicare covers roughly 80% of health care costs. This may seem like a great deal. On the other hand, if you have any type of doctor’s visit or hospital stay you will be required to pay out of pocket for the remaining 20%. Imagine a $100K bill. You would be responsible for $20K. Nobody wants that.

The next question I usually get is how I can cover the remaining 20%. The answer is simple. Sign up for a Medicare supplement plan or a Medicare advantage plan. These plans cover the remaining amount. Similarly, it is important to sign up for the right plan for you.

Local Broker

Make sure to choose a local broker to review the different types of plans that are offered in Nevada. In addition, this is where I let my clients know to CALL A LOCAL BROKER. If you miss this step in the process you will miss out on the local Medicare plan options.

Keep in mind that if you speak to a national broker who only sells national plans you will miss out on ALL of your options. I stress this point because there are two companies here in Reno that offer local plans. These plans are some of the strongest benefit plans in the Medicare advantage market.

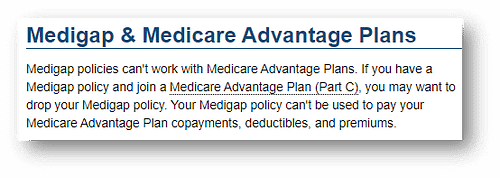

If you go with a Medicare supplement plan you will be on a different trajectory. Not a better or worse trajectory, just a different one. In saying that, keep in mind that a Supplement plan is much different than a Medicare advantage plan.

Ancillary Benefits

Medicare Advantage plans usually come with a dental, vision, and other benefits that Medicare Supplement plans do not include. On the other hand, the tradeoffs are that Medicare supplement plans are accepted by any doctor in the country that accepts original Medicare.

Medicare Advantage plans are limited to the network. This is important to understand so you do not end up paying a large bill out of pocket. On the other hand, if you need a service that your network does not approve, you will be able to go out of state. For example, you may end up at Stanford to get a service completed.

A to Z

Don’t go at this alone. Take a Medicare guide with you. This is another reason to seek out professional help. Here at Health Benefits, we have licensed Medicare brokers who will be happy to walk you through the Medicare adventure from A to Z.

In fact, if you were to go with a national broker, your favorite specialist might not be included in your plan. This is the last thing that I or any of my colleagues want. Our main goal is to connect our clients with the plan that suits them.

The Process

Once you begin this process our office is an open door. Our phones are on and we enjoy answering all of your questions. In turn, there will be because Medicare is confusing!

Medicare supplements plans do not include Part D. Part D is prescription drug coverage. D for drugs is an easy way to remember this one. It is imperative that you sign up for a Part D plan at the same time as your Medicare Advantage or supplement plan. You will face a lifetime penalty if you do not sign up in time.

Conclusion

In closing, I know that Medicare is confusing. Keep in mind, things become more clear when you get help. An expert in the Medicare field is here to help. Remember, go local, and understand all of your options. This is why for fellow Nevadans, I suggest going with a broker based in this great state of ours.