Guide for Signing up on Nevada Medicare

There are a lot of negative connotations with getting older. But I am here to give you some great news. Getting on to Medicare is not one of those negative things. Before you turn 65, you will be flooded with offers from all sorts of companies. That’s where we come in. We are here to sort all of that information out for you and make your transition into Medicare that much easier. Here is a comprehensive guide for signing up on Nevada Medicare plans.

Getting Started

Not everyone is automatically signed up on Medicare when they turn 65. Most people will have to go through the process by themselves. The easiest way to do it will be to go online to the Social Security Administrations website. You can find everything here for the SSA website. When you get to the website, be sure to scroll halfway down and click on the sign up for Medicare only button.

However, there is another choice. If you would rather , then you can always call the SSA at (800) 772-1213.

Understanding Parts A and B

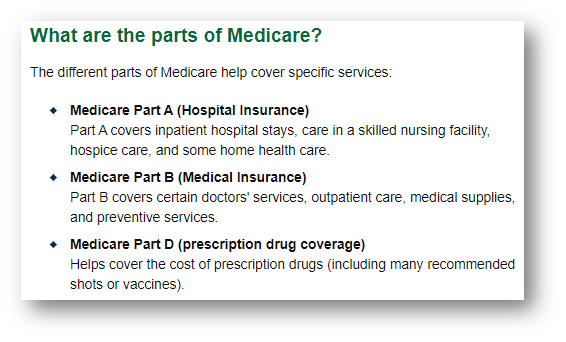

When enrolling in Medicare there are a few parts that you will need to familiarize yourself with. The main parts you will need to know are parts A and B. Once you have signed up for part A and B, you will be able to enroll in plans offered by private insurance companies.

Part A

Most people will qualify for premium-free part A. As long as you or your spouse have worked for 10 years or 40 quarters of your life and paid into Medicare, then you will receive Part A with no charge. Those who have not filled these requirement will be charged a premium for part A.

As mentioned above, part A will pay for:

- Inpatient Hospitalization

- Skilled Nursing Facilities

- Hospice Care

- Home Health Care

Part A will pay for 80% of these services. After that, you are left with 20% of the bill.

Part B

Even though part A usually does not have a premium associated with it, part B does. I will jump into the premiums associated with part B in just a bit. As for now, we will go over what par B covers.

Part B covers:

- Services from doctors (outpatient services)

- Outpatient Hospital Care

- Home Health Care

- Durable Medical Equipment

- Preventative Screenings

Part A as well as Part B covers 80% of your approved medical bills and you are left with 20%

Costs When Signing up for Nevada Medicare

Like I mentioned above, there will be a few costs when signing up for original Medicare. The cost that most people will deal with is the Income Related Monthly Adjustment Amount, or IRMAA. The Part B premiums will be determined by your income from two years prior. For example, if you turn 65 in 2021, your part B premium is determined by your 2019 tax returns. Below is a chart that outlines the 2021 IRMAA costs for Part B as well as Part D.

Understanding Your Options

Now that you have finished enrolling in Original Medicare, you are ready to enroll in a private Medicare plan. As I mentioned above, Part A and Part B will pay for 80% of your approved Medical services. This means you are responsible for 20% of the bill. That can be 20% of $10 or that can be 20% of $10,000. This is where private Medicare plans are to help.

Medicare Advantage

Medicare Advantage, also know as Part C of Medicare, is one of the two main options for people when they turn 65. Because of the benefits, these plans have been increasing in enrollment numbers year after year.

Medicare Advantage, however, does have its pros and cons. Medicare Advantage acts a lot like a group plan that people may be on currently. These plans are primarily made up of copayments and have very little deductible requirements but that is determined by the company that sells the plan.

Another pro of Medicare Advantage plans is going to be the affordability of them. Majority of the plan premiums in Northern Nevada are getting lower and lower each year. Some plans even have $0 premiums as well as low out of pocket expenses.

The one thing you will need to look out for with Medicare Advantage is that you must follow the network list provided by the company you enroll with.

Although, the nice thing about Medicare Advantage is that every year during the Annual Enrollment Period (October 15th – December 7th) you can switch from one Medicare Advantage Company to another with NO HEALTH QUESTIONS. When you switch, the effective date of the new policy will be January 1st.

Medicare Supplement Plans

Much like Medicare Advantage plans, Medicare Supplement plans are there to help you with the 20% leftover by the government. Medicare supplement plans, however, do have a premium attached to them. These premiums range from company to company but do stay around the same price as each other.

Knowing the rate trend can help you decide on what company to go with.

There are plans ranging from Plan A to Plan N available for Medicare Supplement. The chart below lists them all as well as what they cover.

The recommendation we usually make for people is Medicare Supplement Plan G. Plan G is the most comprehensive benefit plan out there currently. Plan G will cover 100% of your medical expenses outside of the Part B deductible.

Medicare Supplement plans do not follow a network list, unlike Medicare Advantage plans. As long as a doctor accepts Original Medicare, then they will accept a supplemental policy. This gives people the freedom to choose doctors at big name hospitals such as Stanford, UCSF, and Mayo Clinic.

Part D

Medicare Supplement plans as well as some Medicare Advantage plans do not come with a Part D prescription drug plan. Some people will have to enroll in these separately. These plans range in price anywhere from $7-$60 a month.

Next Steps

Now that I have thoroughly confused everyone, lets take a look at our next steps. First thing you should do is call a broker, like us! Not just a selfish plug, but brokers who contract with every company are able to do the hard work for you. We can shop around year to year and make sure you are in the best possible position for your healthcare. If you would like to schedule an appointment with any of us, give us a call at 775-828-1216 or visit us at either of our locations in Reno or Carson City.