Top Tips and Tricks of Medigap Plans

You might be asking yourself, are Medigap plans worth the money in Nevada? That is a great question! I am going to break down some of the tops and tricks to save money on a Medigap plan.

What is a Medigap?

In simple terms, Medigap plans are the part of Original Medicare that covers the remaining 20% that you are responsible for. These plans come in all shapes and sizes as well as letters. Medigap plans range from Plan A to Plan N so there can be a lot of confusion on that end as well. Before we get in to all the ways we can save money, let’s go over how to qualify for these plans.

Qualifying for Medigap

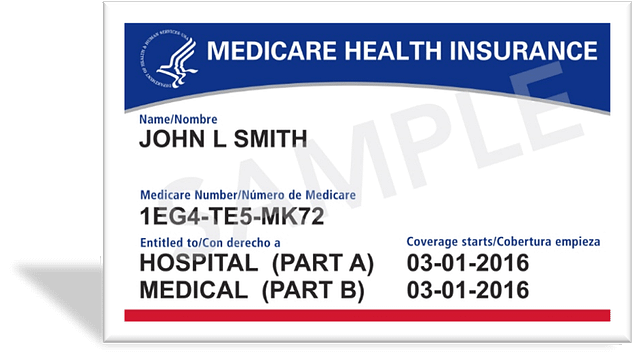

Let’s talk about how to qualify for the plans. The first step to getting a Medigap plan is to have Medicare Parts A and B. If you have your Medicare card then you are eligible to apply for any of the Medigap plans pictured above. Once you have Medicare parts A and B you will be able to receive coverage one of two ways.

Applying for Medigap Plans

- Guaranteed Issue

The first way to receive coverage through a Medigap plan is by applying within the first six months of becoming Medicare eligible. Once your Part B of Medicare starts, you will then have a six month window to apply. You may apply for any available Medigap plan and be able to obtain coverage with no health questions.

2. Answering Health Questions

The second way to qualify for a Medigap plan is to answer a set of health questions determined by the company that you are applying with. These questions can sometimes be very stringent and one condition could disqualify you from coverage. Each company has their own set of underwriting questions but most are similar. You can see an example of these health questions in the picture above.

Tips to Save you Money!

Now, are Medigap plans worth the money in Nevada? Let’s get in to the top tips and tricks!

Tip #1- Nationwide access to the Nations top Facilities

Remember that you have nationwide access with your plan! As long as a physician accepts Original Medicare, they will accept a Medigap plan. The biggest thing you need to look out for is if they are accepting new patients. How exactly does that save you money? This means that you can bypass having to go to your primary for a referral to the nations top facilities. If you wanted to make an appointment at a top facility like Stanford, you don’t need to wait for a primary physician to make that call. Not only does that save you money, but also saves you time!

Tip #2- You can switch plans at any time of the year.

You can switch plans at any time of the year! Remember how I said you can answer questions with underwriting? That’s because Medigap plans allow you to switch your plan at any time of the year. If you don’t enjoy how your Medigap plan works, you can take a look at new ones a few months later. As long as you can pass the underwriting questions then you are good to go! A good example would be if you have a Plan F Medigap plan and have high rates, then you can try to pass underwriting questions and switch in to a lower costing plan.

Tip #3- No need to get referrals

This might be the best perk of having a Medigap plan. This also ties in to the first tip of nationwide access to the top facilities. On a Medigap plan, there are no need for referrals. You can bypass your primary care physician and make an appointment directly with a specialist. If you needed to make an appointment with a dermatologist, you can give their office a call and start scheduling that appointment. Just remember, you will need to make sure they take Original Medicare first. After you know they take Medicare, you can be assured they accept the Medigap plan REGARDLESS of what company you decide to go with.

Even though different companies offer these plans, every company must offer the exact same medical benefits as the other. These medical benefits are regulated by the federal government.

Tip #4- Worldwide Coverage

People often think of getting Medigap plans when they are frequent travelers due to the nationwide access. But did you know that it doesn’t stop at our nations boarders?

Most Medigap plans have a foreign travel emergency coverage. Most of the Medigap plans will cover up to 80% of your healthcare costs in an emergency on foreign soil. You definitely want to check with plan you have and make sure that it covers foreign emergency. Let’s take Plan G for example. Plan G will cover 80% of your costs up to $50,000. Just remember, that $50,000 is a lifetime maximum. So once you hit the limit, your plan will no longer cover your expenses overseas.

Tip #5- Low Out of Pocket Maximums on Most Plans

I know I said that not having to get referrals was the best perk, but this has it beat. Most Medigap plans have low out of pocket expenses. Once again, we will take plan G as our example. On Plan G, you will have one main expense. That main expense is your Part B deductible. Sounds like it’s going to be a lot right? It’s not.

The Part B deductible in 2021 is $203. That’s it. There are no strings attached. You pay for the first $203 dollars of your medical expenses and the insurance company takes over from there. Every plan is different. So make sure to look at the summary of benefits or consult a health insurance expert to help you look into the benefits.

I hope the above answered your question of “are Medigap plans worth the money in Nevada?”