As we get older, it’s sometimes depressing to think about long-term care as we age. All of us want to die after our “golden years” are over. My grandfather would say, “just take me out back and bury me in the yard….” But this isn’t what really happens.

Instead, we hang on. The recent development of drugs and new technology has allowed us to live better and longer lives. We’re more connected than ever. This allows caretakers to work with us remotely and enables us to stay in our houses longer. Overall the advances in medicine have increased our lifespan and decreased the number of unexpected deaths.

However, with everyone living longer this also means that we have more of our population reaching old age. Additionally, more people are living long enough to develop age-related conditions. They’re living with disabilities and chronic conditions for longer periods of time.

By the year 2020, one of six Americans will be 65 or older!

Today it’s looking fairly likely that we won’t die after our “golden years” like my grandfather wanted. What is our plan for paying for these post-golden years? With the increasing cost of medical care, these could be the most expensive years of our lives. And we could be less able than ever to pay the cost.

- Of men turning 65, 58 percent will need some long-term care.

- Women are more at risk than men—once they turn 65, 79 percent of women will need some long-term care at some point before death.

- Out of the people turning 65, 69% of them will need some care.

- More than half of the current US population will require some type of long-term care before they pass.

FAMILY & FRIENDS

For generations, we’ve taken care of our elderly ourselves. This can be a possibility. Many sons, daughters, and even grandchildren decide to quit their jobs or take on the responsibility in addition to working. For children who have moved away, they decide to move back in with their parents and take on a supportive role. Clearly, this places enormous stress on the child as well as the parent being cared for. Sometimes careers, family or even entire lives are put on hold to care for a loved one.

The biggest risk might not be for those who stop their lives, but instead for those who maintain and try to continue working and pursuing a family of their own. If the caretaker does continue to work and maintain their job they increase their risk for work-related injuries. The employee/caretaker will likely experience lost productivity, workday interruptions, absenteeism, tardiness, increased level of stress, unavailability for overtime, health problems, diminished quality of work and other problems. Overall this can put their career under stress when they will likely need financial support the most.

For caretakers who quit their jobs, the financial burden could be enormous. Medicaid may take care of their parents on a minimum level, however, Medicaid will not support caretakers.

MEDICAID

For many people, this may be the ONLY option. Long-term care insurance may be too expensive. For those who are unable to afford or qualify for the long-term care premiums, Medicaid may be the only option. To qualify for Medicaid you need to be 1. Low income, and 2. Part of a designated eligibility group. Medicaid requires individuals to spend down their assets until they are near or below the federal poverty limit. It’s prohibited to transfer assets and as a result, meet this requirement. Additionally, only a nominal amount of income may be kept each month for personal use, such as $30 or $50. Many people have a plan for our financial future. It usually doesn’t involve spending down our assets to qualify for help from the federal government.

Wait – Doesn’t Medicare cover this? What about a supplement or advantage plan?

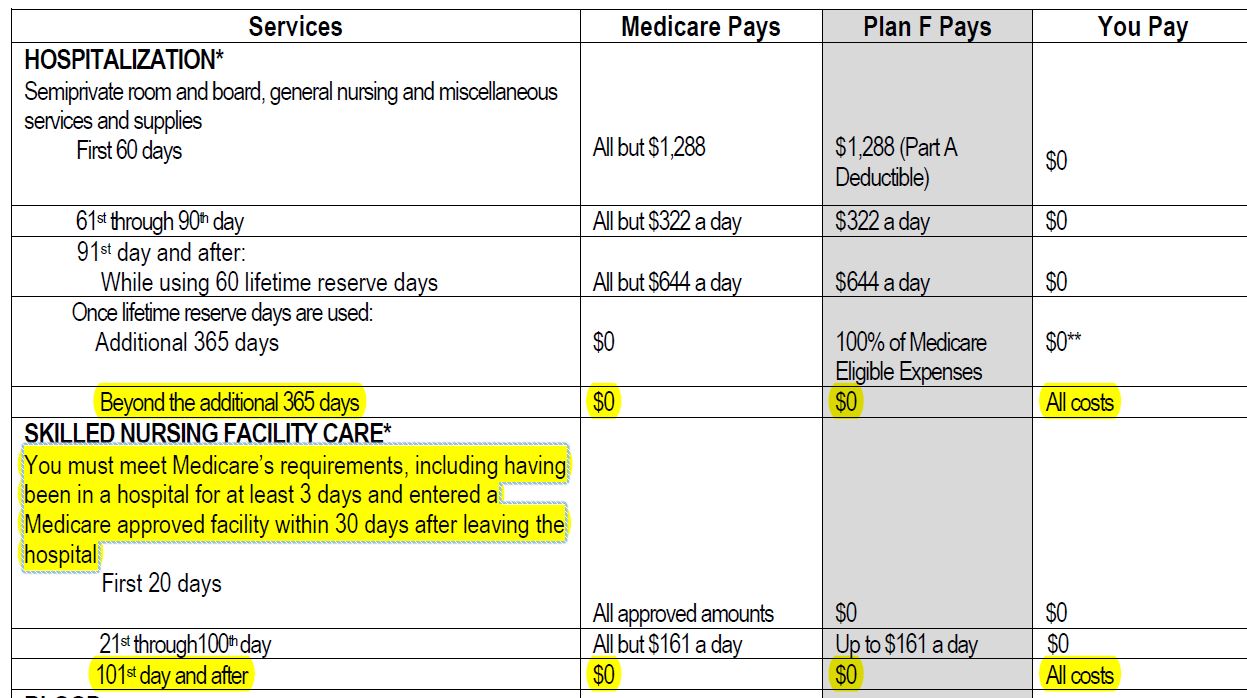

Medicare supplement plans can be a great tool for covering the gaps that Original Medicare leaves. In fact, we recommend Medicare Supplement Reno plans or Medicare Advantage Reno plans to everyone who is eligible for Medicare. The important part: If Medicare covers the service, it’s eligible for coverage by a Medicare Supplement or Medicare Advantage plan. If Medicare does NOT cover it, the supplement/advantage won’t either. For example, if you’re in the hospital over 365 days, Medicare pays nothing and therefore the plan pays nothing.

You’re responsible for all costs.

The coverage for skilled nursing needs to immediately follow a 3+ day hospitalization. After that, they’ll cover the first 100 days of skilled nursing. If skilled nursing lasts for more than 100 days the costs are all on the patient. Medicare Supplement plans don’t cover long-term care services. Long-term care plans cover long-term care services. Please see medicare.gov for more information.

The Best Plan – Long-Term Care Insurance

In order to avoid burdening your family, poverty through Medicaid or the severe limits of Medicare, it’s best to look into long-term care. These policies provide the funding to meet long-term care expenses when the time comes.

It’s important for people to know that these policies are more affordable if they’re bought when you’re younger and healthier.

What does Long-Term Care pay for?

Many long-term care policies sold today are comprehensive. They pay for services in several settings including home care, adult day care centers, assisted living facilities and even skilled nursing facilities.

When does Long-Term care pay?

Each policy will specify the Activities of Daily Living. These include bathing, dressing, toileting, transferring, continence, and eating. Usually, benefits start when the insured member is unable to perform 2 of the 6 activities of daily living. This is also defined as a physical or functional impairment. Benefits can also start if the insured member has a “significant cognitive impairment”. Both the loss of activities of daily living and the significant cognitive impairment need to be medically documented.

There are many other details of each policy. Some keep the cost low by adding waiting periods, benefit periods or lifetime max amounts. Others are for the benefit of the consumer such as inflation protection, rate stability requirements and guaranteed renewability. Many insurance policies including health and life insurance have many of these same requirements.

What about pre-existing conditions?

Long-term care policies do include health questions. They’re not “guarantee issue”, meaning that the insurance company can increase your rate or deny you outright based on your health history. If you have a pre-existing condition it’s worth at least exploring the subject. In our experience, these plans are not nearly as strict as most Medicare Supplement plans. Any Yes answer on a Medicare supplement application will be an immediate denial for the plan. An experienced health insurance broker can advise you whether it’s worth it to apply for a long-term care plan or not.