Complete Guide to the Costs of Medicare

There are so many different parts and plans of Medicare out there that it can be very confusing when trying to figure out the costs of Medicare in Nevada. This is why we have put together a comprehensive guide to all of the costs associated with Medicare.

The Costs of Part A

The most common scenario for beneficiaries of Part A is that they receive it for no cost. This is the result of how long they have worked and paid taxes. If someone has worked and paid taxes for ten years, or 40 quarters, then they will be able to receive Part A premium-free.

There are a few ways to get Part A according to Medicare.gov:

- You are receiving Social Security Income or the Railroad Retirement Board

- You are eligible for benefits with the requirements listed above but have yet to apply for them

- If you are under 65 and have been on Social Security Disability for 24 months.

- You have End-Stage Renal Disease and meet other requirements

There are some people, however, that will have to pay a premium for Part A. The premium will differ depending on the individual’s circumstance. According to Medicare.gov it could be anywhere from $259 to $471 a month in 2021.

The Costs of Part B

This is where things start to get tricky. Part B does is not free. There are multiple costs associated with Part B and you could be subject to higher premiums based on your income.

First, I will go over the different costs of Part B when you enroll. After that, I will go over the potential costs for you if you do not enroll on time and start to incur a penalty.

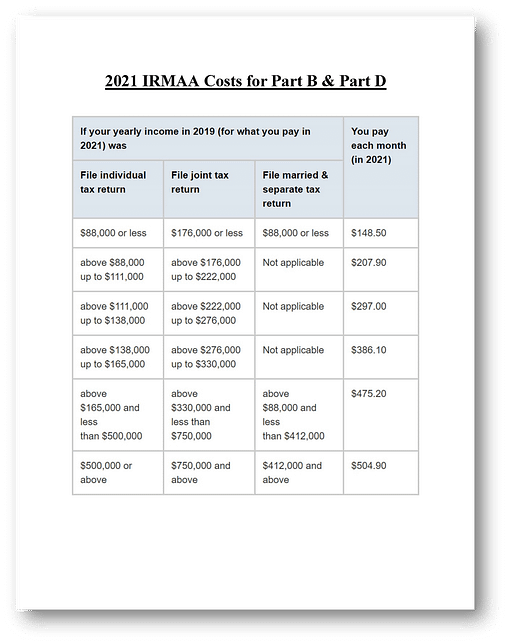

IRMAA

The first thing I want to look at is the Income Related Monthly Adjustment Amount, or IRMAA. This is the part that is going to determine your premium. Anyone who enrolls in Part B of Medicare will be given a premium that is based off of their income. Not only is the premium based off of your income, but it is based off of your income from two years prior.

If you filed single in 2019 and made less than $88,000 then your premium will be $148.50. The premiums go up depending on how much you made two years ago.

Even though I say two years, you can always request a one year lookback on your taxes. This situation typically comes up when someone retired and they made an amount that falls into the higher IRMAA bracket but their previous years income falls into a lower bracket.

The best way to find out how to go about the IRMAA appeal process is to contact your local broker or contact the Social Security Administration to get the proper form.

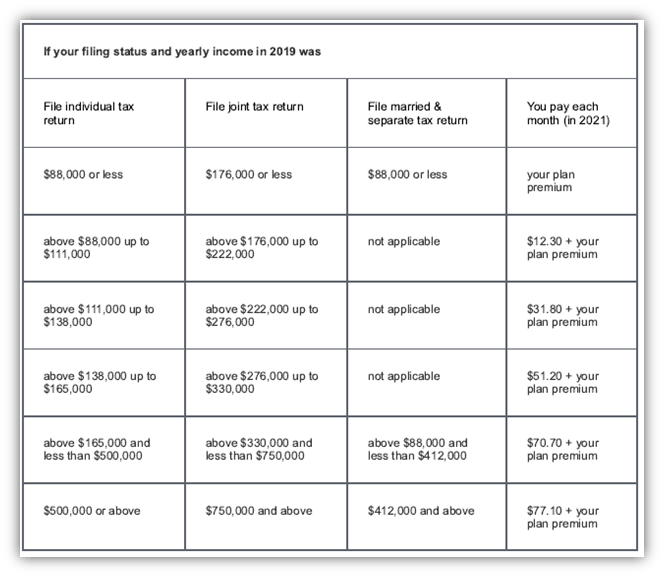

The Costs of Part D

the costs of Part D comes in to play when you have purchased a Medicare supplement plan that does not come with drug coverage. There will actually be two separate costs associated with your Part D prescription drug plan.

The first cost being the actual drug plan cost. This cost is determined by the insurance company. The next cost will be determined by your income bracket. Much like the Part B IRMAA charge, the drug plan follows the same income brackets. This is a cost you will have to pay regardless of whether you enroll in a standalone drug plan or a Medicare Advantage + Drug Plan.

Late Enrollment Penalties

Part B

Now comes more costs associated with Part B and Part D. Thankfully, you can avoid these penalties by enrolling during your initial enrollment period or by having creditable coverage. To learn more about your initial enrollment periods, head over to our Complete Guide to Medicare.

The Part B late enrollment penalty is calculated by the amount of years you have gone without Part B. For every 12 month period that you are not enrolled in Part B, you will have to pay a 10% premium penalty. That means if you became eligible for Medicare Part B three years ago, you would be paying your normal premium (based on IRMAA) as well as 30% on top of that.

Unfortunately, there are only certain times that you can enroll in Part B. If you miss your initial enrollment then you will need to enroll during the General Enrollment Period (January 1st- March 31st with an effective date of July 1st)

Sounds confusing right? Here is an example right from the Medicare Website.

Part D

The Part D late enrollment penalty is much easier to understand. For every month that an individual does not have a Part D prescription drug plan they will be penalized 1% of the average drug premium. As a result, this will be added on to the Part D plan that an individual enrolls in for the rest of their life.

Here is an example from the Medicare website.

Medicare Supplement

This is where the prices start to differ. Medicare supplement policies are offered by private insurance companies but regulated by the federal government. This means that each company has to provide the exact same medical benefits. The main difference between the companies is going to be the pricing.

As brokers, we look at the premium trend from each company and that is what we base our recommendations on. All of these premiums will go up each year. Our goal is to keep you in a plan that stays lower for longer. We want to make sure to keep your costs low.

Another cost you will need to know is the Part B deductible amount. This changes year to year. In 2021 the Part B deductible is $203. The reason I bring this up under the Medicare supplement portion is because all of the available plans are subject to the Part B deductible.

Medicare Advantage

Medicare Advantage premiums have been getting lower and lower each year. Now, five out of the six insurance companies in Nevada do not charge a premium for their policies. The best way to look at these plans is to get in contact with your local broker.

Along with the $0 premium that some plans have, there are low out of pocket costs as well. Medicare Advantage plans consist of copays and low out of pocket maximums. The max out of pocket can range between $2,900 a year and $7,550 a year.